To promote green energy sources, Norway’s Government Pension Fund Global has sold off its equity investments in Indian coal-producing/user companies and increased exposure in favour of infotech, automobile and banking sector, statistics submitted to the stock exchanges show. The Norwegian pension fund is managed by Norges Bank Investment Management for the country’s finance ministry.

The fund has sold off investments in Coal India, NTPC, Tata Power, Reliance Infrastructure, Reliance Power, CESC, and Gujarat Mineral Development Corporation. These companies either produce coal or meet above 30 per cent of their fuel requirements from thermal coal, which is considered as harmful to the environment. The sell-off in the Indian coal companies is part of a global pruning exercise, in which the fund sold investments in 53 companies. The funds want the companies to reduce their dependence on coal and increase the usage of renewable energy sources such as solar and wind power.

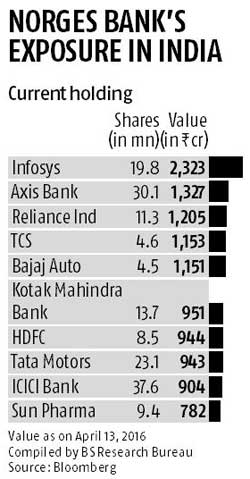

Norges Bank’s biggest exposure in India currently is in Infosys (Rs 2,323 crore), followed by Axis Bank (Rs 1,326 crore), and Reliance Industries (Rs 1,204 crore), statistics by Bloomberg show. The Norwegian pension fund has also invested nearly $4 billion in Indian government bonds, according to its 2015 annual report. The fund has a market value of nearly $862 billion, making it the largest pension fund in the world.

The decision comes in the wake of the Norwegian government asking Norges Bank to exclude companies that use thermal coal from the pension fund. The new criterion states that coal power companies and mining companies who themselves, or through other operations they control, base 30 per cent or more of their activities on coal, and/or derive 30 per cent of their revenues from coal, may be excluded from the fund. This is likely to have a ripple effect on other pension funds in the region. Another big investor in Indian equities, Denmark, is also considering a similar move.

Coal-based power stations are said to be a big contributor to greenhouse gas emissions, impacting global environment. Some of the world’s largest banks refused to invest in Australian coal mines to be developed by the Adani and GVK group, citing the new norms that bar investments in coal mines.

Coal-based power stations are said to be a big contributor to greenhouse gas emissions, impacting global environment. Some of the world’s largest banks refused to invest in Australian coal mines to be developed by the Adani and GVK group, citing the new norms that bar investments in coal mines.

source: Business Standard