Untangling the grid: Overcoming transmission bottlenecks and policy challenges

by Sabyasachi Majumdar, Senior Director, CareEdge Ratings

CareEdge identifies several key challenges that need to be addressed to scale up the renewable energy sector. These include execution challenges such as land acquisition issues, rights of way, and transmission bottlenecks. Additionally, the sector faces significant risks due to the weak financial health of distribution companies (discoms), which exposes renewable energy companies to counterparty credit risks. There are also risks associated with changes in law, tariffs, and duties on components, which can affect the financial viability of renewable energy projects.

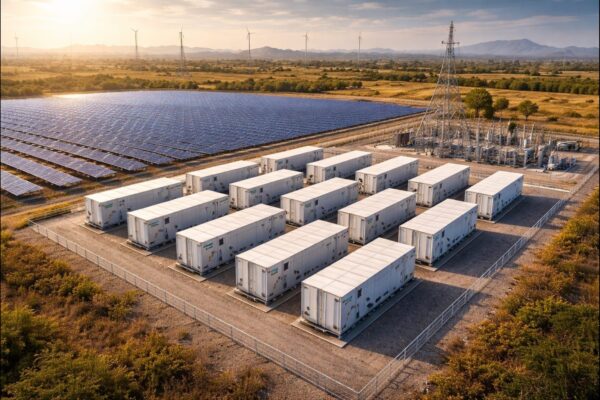

Furthermore, commercial and industrial (C&I) players are vulnerable to adverse changes in wheeling charges, cross-subsidy surcharges, and additional surcharges, all of which can undermine project viability. The rooftop solar segment has seen slow growth, largely due to inconsistent support from state authorities. Moreover, the sector's intermittent nature makes it dependent on adequate energy storage capacities, which are currently insufficient. Lastly, the limited availability of domestic capacity for key components used in solar panels, wind turbines, and batteries poses a risk, as it increases dependence on imports, which can be affected by geopolitical factors.

Therefore, it is crucial that the policy and regulatory frameworks put in place address these risks, enabling the sector to scale up and achieve the 500 GW target.

Policy framework to sort out execution challenges in the RE sector: What has emerged as a key bottleneck for the growth of the capacity is the transmission bottleneck in key solar and wind resource rich regions such as Rajasthan and Gujarat. These have arisen out of factors like unavailability of land for substations and rights of way and the Great Indian Bustard issue. In other states too, availability of land for RE plants, particularly in the case of wind energy projects, which are dispersed and very microsite specific remains a challenge. In addition, availability of transmission networks at state level and right of way connecting plants to state transcos also remains an area of concern. The central govt needs to work closely with the Central Transmission Utility and the state government to sort out these issues. State governments need to put in place policies which smoothen out land acquisition and transmission linkages. The government also needs to continue with exemption from transmission charges for RE players.

Expediting distribution sector reforms: The Central government has already put in place the LPS mechanism which has resulted in timely payments for over a year now. The Government has put in place additional measures to improve financial health of Discoms with streamlining the process of accounting, reporting, billing and payment of subsidy by States to the Distribution Companies. These measures need to be persisted with. With discoms in several states still remaining loss making, state governments need to expedite reform measures including roll out of loss reduction measures including smart meters. In addition, the tariff setting process needs to be depoliticised and adequate funding should be provided to government departments and local bodies, which are currently in delay of payments to discoms.

Strengthening of the regulatory process especially at the state level: The tariffs of RE projects are by and large determined by bid based tariffs. However, there can be changes arising due to factors which are beyond the control of developers. These factors include change in law conditions (such as change in taxes, duties, etc) or delayed project commencement due to delays on part of CTUs/STUs in providing transmission connections. While these are generally pass through, it often takes a long while for ERCs to adjudicate on the same and for the same then to be recovered through billing process. A policy framework needs to be put in place for ensuring that such processes are completed in a time bound manner.

Rationalising of charges, open access policies at state levels: While the C&I segment has shown a healthy growth driven partly by improving cost economics and also the increasing regulatory/investor requirement to green the corporate processes, the growth of the market is restricted by restrictions being placed by various state regulators, partly with a view to protecting the interests of the state discoms, which risk loss of high paying customers. As a result, there have been tightening of norms on banking facilities as well as imposition of additional surcharges which make supply from RE C&I players uncompetitive. Viewed against this backdrop, a harmonisation of the norms with respect to banking, availability of transmission open access and cross subsidy/additional surcharges across various states so as to balance the interests of both RE players and discoms will be very critical.

An issue which is impacting the development of rooftop solar, including those by C&I customers is the inconsistent net metering policies across states and their varied implementation. Net metering is critical for the financial viability of a rooftop solar plant. To protect their economic interests, DISCOMs sometimes delay the net metering approval or fail to provide approval altogether, especially to C&I customers. Policy framework should be put in place which ensures timely net metering implementation.

Another related issue is related to implementation of Green Energy Open Access. Many states have sought to delay the implementation of GEOA. Where GEOA is allowed, state regulations don’t allow a consumer to avail both GEOA and rooftop solar simultaneously. This issue needs to be sorted out too.

Expediting build-up of energy storage capacities: With robust demand growth and limited possibility of thermal addition in the next three years, likelihood of supply shortage in the non solar hours cannot be ruled out. Therefore, the government needs to promote both battery and pumped storage. For battery storage, increasing VGF so that storage becomes cost competitive till the intrinsic cost of battery usage comes down will be critical. The state governments need to smoothen about clearances required for expediting pumped storage (especially w.r.t land, water). In addition to pumped storage, policy framework needs to be strengthened for development of conventional hydro power projects as well. Given that most new hydro power projects will necessarily have to be built in more challenging terrain in Arunachal Pradesh and remote locations in J&K, HP and Uttaranchal, the central and state governments will have to put in place mechanisms so that the cost of infrastructure development (which is a substantial part of the total project cost) is borne by the exchequer so that the new hydro projects can be more economical. Govt should also gradually increase hydro power obligation (HPO) to encourage offtake from the new hydro power plants. Tariff norms for such plants can also be tweaked (for instance a longer period for recovery of debt servicing cost by way of depreciation) to make tariffs more affordable.

Development of domestic manufacturing ecosystem for wind, solar and battery storage: The government needs to develop the domestic manufacturing ecosystem for wind, solar and battery storage through policy measures such as speedy approvals, provision for land close to port locations on a cluster basis. In addition, the government can continue with PLI incentives for domestic manufacturers.