Surge of commercial development in Tier 2 Cities

by Hardik Pandit, Director, APICES Studio

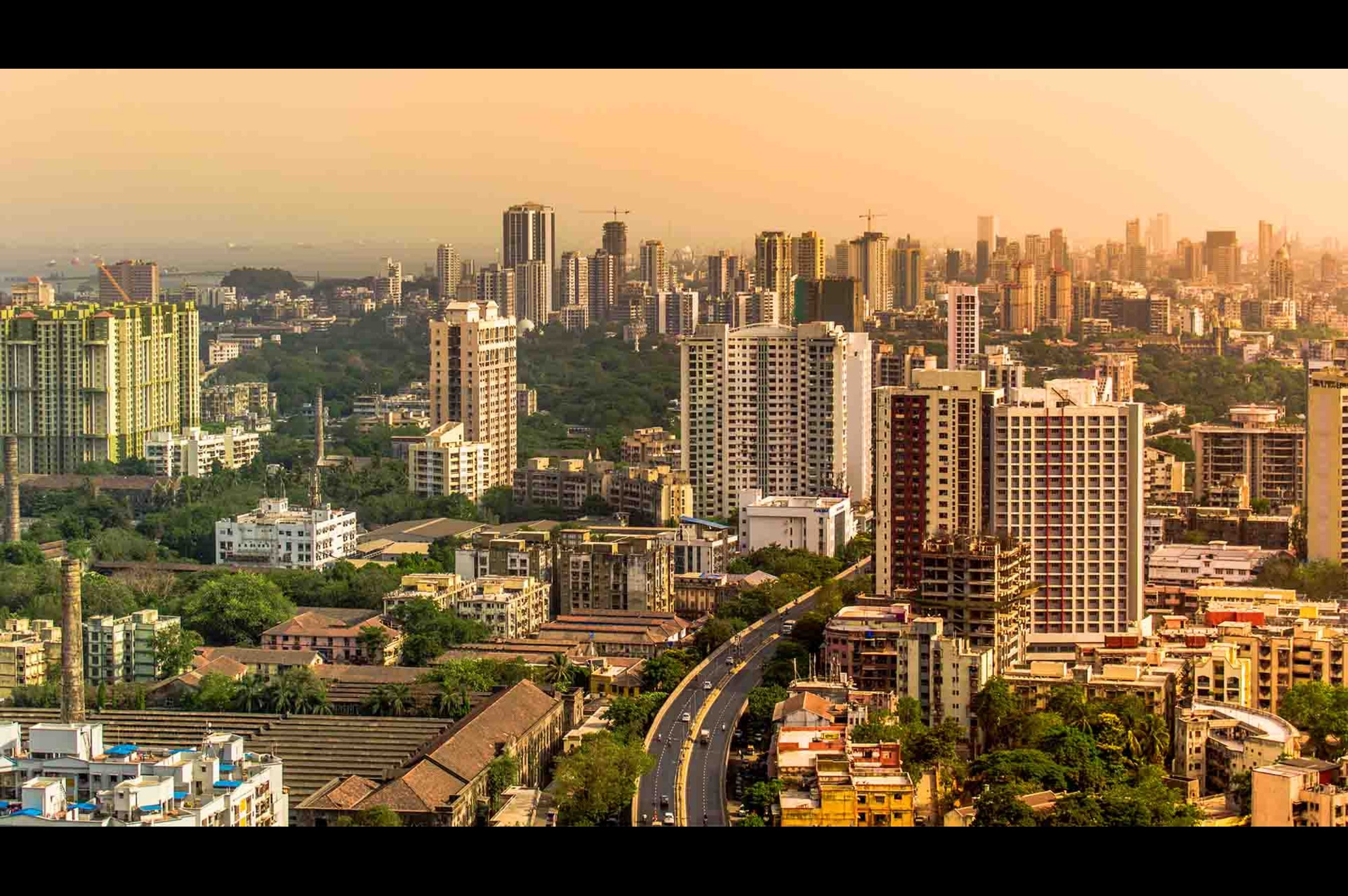

India’s Tier 2 and 3 cities are rapidly transforming into vibrant hubs of commerce, real estate, and infrastructure. Driven by decentralisation, digital adoption, and rising investor confidence, these non-metro cities are witnessing growth in IT parks, co-working spaces, healthcare, and data centres—positioning them as key drivers of India’s next economic leap

Over the past few years, India’s Tier 2 and 3 cities have undergone a quiet but powerful transformation. Indore, Jaipur, Bhubaneswar, Coimbatore, and Lucknow are no longer considered peripheral to metro economies. They are now centers of commercial activity, infrastructure investment, and sectoral growth. This signals a shift in India’s economic geography as it is increasingly being shaped by decentralisation, access to digital technology, and demand-driven planning.

The driving forces: Decentralisation, efficiency, and MNC expansion

Demand for hybrid and remote work options has paved the way for more agile business operations, prompting companies and several multinationals to search outside traditional metro regions. These Tier 2 and 3 cities have skilled labor, lower costs for land and labor, and a quicker rate of return for regulatory approvals. As a result, there is a drastic increase in the need for industrial hubs along with IT parks and high-end office spaces.

The IT/ITeS, BFSI, logistics, healthcare, and startup sectors led demand for Grade A office space of over 15% in Tier 2 cities in FY24. Predicted growth rates indicate that non-metro markets will see a compound annual growth rate over two decades of more than 20 percent in commercial stock until 2027. Surat and Ahmedabad lead these remarkable growths supported through aggressive non-captivity policies, planned development corridors, and robust infrastructure pipelines.

Evolving solutions for public infrastructure and parking

Urban development projects such as Smart Cities Mission, AMRUT, and Gati Shakti are leading to more public investments for improved water and sewage systems, integrated public transport, wider roads, and last-mile connectivity.

One of the key focus areas in these business district frameworks is advanced parking and vehicle traffic management systems. To accommodate the rising foot and vehicle traffic, local authorities and private investors are adopting multi-story parking facilities, advanced parking detection systems, and integrated mobility solutions. This investment improves business efficiency and reduces traffic congestion.

Co-working spaces and data centers emergence

The recent trends in work culture have also caused an increase in co-working spaces in Tier 2 cities. They are popular among freelancers, remote staff for larger corporations, MSMEs, and startups. Their flexible lease options and low overheads make them more cost-effective than traditional office spaces.

Concurrently, the expansion of digital infrastructure is driving a surge in the construction of data centers. Due to cost-effective land availability, access to power, and favorable climate conditions, Nagpur and Nashik are emerging as strategic data center hubs. With increased data consumption, these cities are poised to become integral to India’s digital economy.

Healthcare infrastructure: A focus area of interest

Medical infrastructure gaps have been most pronounced in Tier 2 and Tier 3 cities, which are now witnessing rapid transformation. State and PPP model incentives are aiding the expansion of private hospital chains, diagnostic labs, and medical colleges within these regions.

The advancement of greenfield healthcare projects is being actively pursued in non-metro regions by states such as Odisha, Madhya Pradesh, and Uttar Pradesh. This creates an opportunity for architects and urban designers to innovate and build patient-centric, tech-enabled, and sustainable healthcare campuses that serve the expanding urban and peri-urban populations.

Investment outlook

Several businesses have significantly enhanced the Tier 2 and 3 city infrastructure with stable occupational rates as well boosting investment opportunities. Over 2 billion dollars’ worth of commercial real estate investment is expected to flow into these urban centers over the next three years. With a focus on mixed-use developments, institutional developers and private equity funds are purchasing land while REITs are assessing their office and co-working portfolios for sites with strong long-term returns.

Looking ahead

The narrative of urbanization in India is moving beyond the top metros. Because of high levels of digital adoption, public-private partnerships, and infrastructure-centric planning, Tier 2 and 3 cities are no longer subordinate; they have become self-sustaining and thriving ecosystems. Cities such as Surat and Ahmadabad, Nagpur, Nashik, and Bhubaneshwar are becoming self-sustaining economic growth engines that will accelerate India’s next economic leap.

Tags