Paving Progressive Pathways

Roadways have always been a demand driving sector for the equipment manufacturing industry. With the Government increasing its focus on infrastructure investments, opportunities are shooting up for the equipment manufacturers.

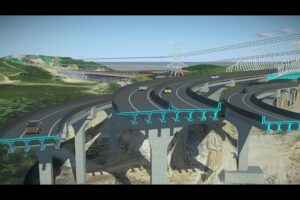

Connectivity is one among the crucial deciding determinants in a country’s socio-economic and political progress. It is of vital importance especially for developing economies like India, which are gearing to eagerly achieve the developed status. Roadways are one such sector playing a vital role in strengthening the country’s infrastructure, by connecting nooks and corners of the country. Stretching to even the areas uncovered by the majestic rail networks, roadways exists as the second most important mode of transportation in India. Roadways in India carry around 85 per cent of the passengers and 70 per cent of the freight traffic of the country. But, a concerning alarm faced by the nation today is that the country’s highways make up only 2 per cent of the road network by length, and carry around 40 per cent of the total traffic. Furthermore, the need for high-quality road networks have emerged as a need of the hour, with the country’s fast-pacing urbanization and exploding population.

“Our country’s road network extends to 52 lakh km, of which only 96,000 km was National Highway and 40 per cent of the country’s traffic is on this 2 per cent road. So, we have taken a decision to increase the span from 96,000 km to 2,00,000km, out of which 1,70,000 km has been declared. 80 per cent traffic of the country then will run on National Highway,” mentioned Shri Nitin Gadkari, Union Minister for Road Transport and Highways recently while addressing the media.

While the Government has put forth numerous such progressive plans of development to strengthen the country’s road networks, the situation calls for efficient and well-equipped machineries that can strongly back in constructing such progressive pathways. Thanks to the innovative approach of the equipment manufacturers, today a rapid evolution is being seen in the technical capabilities of road construction equipment. So much that today road construction equipment occupies a major share in the total equipment market pie in India.

Opportunities on the Rise

A promising demand pull is seen towards the road construction equipment, especially like excavators, diggers, loaders, scrapers and bulldozers etc. Industry analysts view the increased focus and spending on infrastructure as one among the root causes for this demand pull. The Government’s budgetary allocation for the fiscal FY8-19 is anticipated to be around $92 billion, which is up by 21 per cent from $76 billion in FY17-18 period. Thus, indicating a clear and increased focus on infrastructure spending – thereby broadening the scope of opportunities for the road construction equipment manufacturers.

“The road sector has been the key demand driver. The NHAI construction per day has jumped from 23kms/day in FY16-17 to 28 kms/day in FY17-18 . The Government aims to reach 41kms/day in FY18-19. New marquee projects like Bharatmala, elevated express highway are going to be game changers in the development of roads. The budgetary allocation for MORTH in FY1819 is up 9 per cent from Rs. 64,900 crore to Rs.71,000 crore. There is a specific focus on rural road development under PMGSY. We have already seen 1.7 lakh km of rural roads constructed in the last four years. The budgetary allocation for FY18-19 is higher by 12 per cent as compared to the previous year for rural roads. All these initiatives by the government are going to drive the demand for road construction machinery in the next few years,” views Arvind Garg, President, Indian Construction Equipment Manufacturers Association and Executive VP & Head, Mining & Construction Equipment Business of Larsen & Toubro Ltd.

Commenting on similar lines Dimitrov Krishnan, Vice President and Head of Volvo CE India says, “The government continues to place priority on building roads and bridges—allocating budget to build 35,000 km of road under phase one of the Bharatmala project, along with allocations for urban rail and airport expansion projects. The drive to improve infrastructure will unquestionably facilitate further growth in the economy and the construction equipment industry.”

According to Bajrang Kumar Choudhary, Managing Director- Bharat Road Network Ltd, “With the commencement of the Bharatmala programme and start of the road monetization programme under Toll Operate Transfer (TOT) mode, investments in Roads is envisaged to expand significantly going ahead. Furthermore, the Government’s 40km/day road construction target (currently at ~21km/day) and large bid pipeline is expected to ensure that NHAI’s project award over the next couple of quarters remains robust. While both the central and some key state government heading up towards election next year, we do believe that capex allocation for infrastructure to remain encouraging and would continue to drive growth for road focused companies.” The company is focused on the development, implementation, operation and maintenance of roads/highways projects and functions on a BOT basis.

Reviewing on the opportunities drawn from the road sector, Ramesh Palagiri, Managing Director & CEO, Wirtgen India shares, “The last few years have been very good with respect to awards and constructions of road projects. We expect this trend to continue with construction of 19kms/day and the Government working towards 30 km/day. With the infrastructure development polices of this Government, there is a good demand and growth for the CE industry. The current government has ambitious plans to develop the road sector. Now the plans are being executed well, and due to this there is an increase in demand for equipment. We being market leaders for Road building and Road rehabilitation have benefitted from this demand and expect this growth to continue.”

V.G. Sakthikumar, Managing Director, Schwing Stetter Sales and Services Pvt Ltd, echoes, “The current market for road construction equipment is in a state of good growth. The construction equipment industry has begun to see a general resurgence in equipment buying mainly driven by the Government projects. According to a joint report by Indian Construction Equipment Manufacturers Association (ICEMA) and the Confederation of Indian Industry (CII), resurgence in buying in construction equipment industry touched a high of about $5.8 billion, including spares and exports, in fiscal 2016-17. The slump from the previous years was due to a mix of policy paralysis, land acquisition challenges and resultant implementation issues. The demand is completely dependent on which sector project get awarded, when it’s a road project, the equipment required for it comes in compact size as well as in huge size. In future, we expect more higher capacity machine will be used to meet the growing need for fast completion of projects.”

Innovating With the Need

With the demand galloping for technically sound and self-sufficient equipment able to construct and maintain high quality roadways, the equipment manufacturing sector have been ambitiously gearing and sprouting with thoughtful innovations. Along with these evolving opportunities is the need to meet tighter project deadlines with increased construction complexities – boosting the equipment manufacturers to innovate and forge ahead. Owing to these needs, analysts’ points out an increasing demand pull towards equipment functioning on real-time basis especially those equipped with abilities to communicate and be self-analytical. The ability of the machineries to draw out performance reports, analyse and suggest resolutions on wear and tear or any such concerns along with the provisions to access and even operate on remote controlled basis has further expanded the demand for self-sufficient equipment on the run.

JCB India is one such major to introduce the first backhoe loader with five world’s first features, including an AMT, which is an Automated Manual Transmission called Easy Shift. Through its recent launch JCB India has become the first manufacturer in the world to offer Easy Shift AMT on a Backhoe Loader. The technology allows gear shifting to take place with no operator effort through a rotating knob below steering wheel thus, replacing the gear lever. This facilitates ease of operation, a rested operator and also ensures better productivity.

This new Backhoe Loader is packed with 30 new innovative features, including 15 industry firsts, and five World’s first such as an SOS switch, Economy and Power Mode, Guide me home, Smart App machine Diagnostics.

Another major involved in the sector to come with a thoughtful innovation is Volvo CE. Sharing about the innovative addition, Krishnan says, “Increasingly customers need to do more with less, that’s why many of them have opted to monitor their fleet with our telematics system. CareTrack is a telematics system that gives equipment owners access to a wide range of machine monitoring information that can help save time and money. The system generates a wide range of reports with data on aspects such as fuel consumption, operational hours, geographical location and more. These reports are available via a web portal or can be received via SMS or email alerts. CareTrack can also be used to manage machine servicing and wear parts. This allows fleet managers to reduce fuel costs, optimize machine and operator performance, as well as proactively manage service and maintenance to maximize uptime.With CareTrack, customers can monitor load efficiency, number of cycles, overload percentages and identify operator training needs.”

Apart from these Volvo CE also offers sensor pavers, wherein two models are manufactured from its Bengaluru plant – the P4370B ABG and the P5320 ABG. Both these machineries offer a maximum paving width of 7 m. Sensor pavers have intelligent operating technology that help control the machine in terms of mat thickness as well as the level of the mat and the grade required in the finished road. “The paving quality of any road is defined by the ability of the paver to satisfy these three requirements in line with the highway design. Regular pavers without sensors simply follow the undulations of the road base and are therefore unable to give a smooth finish to a paved surface. In turn, this affects the traffic flow of the highway and increases maintenance requirements in the finished road,” adds Krishnan.

Sailing on the smart wave, the Wirtgen Group puts forth machineries with better efficiency, improved performances and lower fuel consumption. Palagiri says, “The Wirtgen Group has been continuously innovating its products and all our road technology brands – Wirtgen ,Vogele and Hamm are not only global market leaders but also innovation leaders, the average age of a machine being not more than 3 years.The Wirtgen Group has been consistently developing products which offer better efficiency in terms of fuel consumption and this helps in sustainable development and less carbon emissions, lower life cycle costs and better productivity of these machines.We are ideally placed with regard to offering the integrated service support to customer with regards to not only supplying the most innovative machines in the market , but also backing it with experienced application support team,” He further adds, “With the demand picking up we are increasing our production capacities for the Hamm rollers. On the Vogele front, we have commenced series production of our 6 mtr class wheeled and tracked pavers of the Super Series.We have also made the necessary investment on our after-market and sales support to meet our motto – Close to Our Customers.We expect a stable growth this year and our agenda is to offer innovative products and technologies to our customers which will help them to build better roads at an optimum cost.”

Introducing machineries on the fuel saver line is KobelcoConstruction Equipment with its Generation-10 Hydraulic Excavators. The newly introduced model scales up the level of fuel efficiency with improved performance. Standing to the promise delivered through its tagline ‘Power Meets Efficiency’ the new Generation 10 machine is designed for extreme duty to suit tough applications and complex projects.

While commenting on behalf of Schwing Stetter Sales and Services Pvt Ltd, Sakthikumar, says, “Speed, scale, time bound, concrete mix quality, operator comfort, software integration, are the main factors that drives the technological requirements for the customers while opting for the road construction equipment. Skilling is another area driving the customer demand.” Emphasizing on this need, the company recently, during the last Excon introduced 18 such new machineries into the market. Schwing Stationary Concrete Pumps SP 1015 D/HD and SP 1420 D RMC, Stetter Batching Plant M3, Stetter Self Loading Mixer SLM 2200, GomacoConcrete Paver GP 2600, Schwing Plastering Pump S30HD40-FU-TM100, GomacoConcrete Paver with Independent Dowel bar inserter, XCMG Type Milling Machine XM1003, XCMG Motor Grader GR 1605, XCMG Wheel Loader LW180K, XCMG Rotary Drilling Rig XR220D, XCMG Aerial Work Platform GTJZ1012, GTJZ1212, GTBZ18A1, GTBZ22S, SCHWING – XCMG Tower Crane XT 335 (8020-16) and XCMG Crawler Crane XGC 85.

It could be hence rightly said that with the increasing opportunities and sprouting complexities in the project, the equipment manufacturers have already made their leap much ahead to match the futuristic demands.

Rental Round-Up

Another most sought-out opportunity in the road construction equipment segment is the rental business. Though at its nascent stage, the sub-segment is steadily showing positive signs of growth. According to the market experts, the business is showing promising growth especially in the tier-II and tier-III areas having smaller road projects. India’s challenging terrain condition is a major factor that is driving up the demand for this segment. The diversities in the terrain conditions often results in considerable wear and tear, ultimately creating the need for valuable maintenance. The situation along with the evolving opportunities from the mid-sized to small scale infrastructure projects has boosted the need for equipment on rental basis.

“Cost remains one of the most important factors for buyers in India, but the purchase price is only part of what constitutes a machine’s overall lifetime cost. Equipment owners and contractors in India have developed quite sophisticated models for calculating “cost per tonne” or “cost per km” for equipment, and this considers a range of factors, including purchase price, operating costs, productivity levels, anticipated maintenance, depreciation, resale value and more,” views Krishnan.

While according to Palagiri, “The Rental market for the road building equipment is still not very well developed in India. The market is developed to a certain extent for Compactors but for other equipments like Concrete slipform pavers or Asphalt pavers or for Recycling or Milling machines it is still at a very nascent stage.”

However, an optimistic approach is seen towards the sector’s rental business and is soon expected to grab its space in the larger market pie. The increased infrastructure spending on developing roads and highways across the stretch of the nation remains as a major driving factor to scale up the thrust even in the equipment rental business.

Challenges Ahead

Despite its growing opportunities, like any progressing economic activity, the road construction equipment sector is also clouded with few challenges in its progressive pathway.

“One of the biggest challenge that our industry faces today, is that with regard to framing policy matters. Our sector is very quickly and conveniently related to the Automotive Industry or even Tractor Industry at times. We are a very different industry with varied applications in the area of Construction, Earthmoving, Material handling and Mining using higher powered prime movers. Our sales volumes are much lower. Even today we are being certified by agencies which are primarily engaged in certifying Automotive industry. For these reasons our industry, even today, is regulated only for the machines which have rubber tyre / steel drum and hence a partial regulation. We are highly concerned about safety and environmental exposure which our machines pose to the users of our equipment. For these reasons we surely need a separate and an independent certification agency for regulating safety and emissions,” says Garg.

Pointing out the challenges in policy changes, Sakthikumar states, “One of the key challenges is policy change and its understanding. For example; the Supreme Court verdict on Bharat Stage IV norms wherein the automotive industry was directed to clear up its BS III stocks and ensure that only BS IV vehicles were sold. The construction equipment industry as well as tractor makers too found themselves trapped in this crossfire. In reality, the construction equipment can legally stick to BS III-compliant products. While 65 per cent of the RTOs had no issue, the problem lay with the remaining 35 per cent, who refused to register sales of either tractors and construction equipment. Things started to look tricky and the only way out were to seek the Supreme Court’s intervention to end the impasse. As of now, Delhi has already switched to Bharat Stage-VI (BS-VI) fuels, ahead of the scheduled April 1 launch for the capital. State-run fuel retailers have been pushing cleaner petrol and diesel — similar to, but not exactly the same, as EuroVI fuels — since February to flush supply pipelines and tanks at petrol pumps. Almost all the 397 petrol pumps in the capital are selling (BS-VI) fuels. Soon, the road construction equipment will be adapting to the change.”

While Choudhary expresses a concerned approach towards the bidding prices with the increased scope of opportunities. He says, “There has been a lot of vibrancy in the Roads and Highways sector over the past few months which augur well for both domestic and international road focused companies. Ever since BharatMala projects were announced in October 2017, the sector seems to be galloping ahead with searing pace. The awarding activity has also shifted gear altogether while injecting requisite traction to the investment cycle as NHAI in FY18 alone clocked its best-ever performance by awarding almost 7,400 km of projects worth ~INR1.2tn. However, we do remain a bit concerned on bid prices and would expect a more cautious approach considering the flurry of opportunities in the market.”

On the other hand Krishnan comments on the duty taxes being implied upon. He shares, “While we are proud to support the Government’s Make in India initiative, the government is increasing the import duty from 10 per cent to 15 per cent for a range of parts and components, including for commercial vehicles and bus components, to help drive the initiative and generate additional revenues. This will directly impact our cost and businesses will have to make those associated pricing calls.In separate news, for commercial vehicles and buses there is a chance for GST rates reduction from the current level of 28 per cent.”

Sensing the concerns with the increased opportunities it could be noted that the industry while blooms optimistically also has to surpass few growth hindrances along with the scale of opportunities. However, it is also clearly visible that the equipment manufacturing industry has today moved way beyond the massive hit from the economic slowdown in the past and has pulled up its socks to march towards a prospective future.

@EPC World Media