With stringent regulations in place to ensure timely completion of infrastructure projects, the structural steel industry is playing a crucial role. It is extensively utilized in nearly all infrastructure projects, facilitating faster and punctual completion. With a galore of infrastructure projects in the pipeline, the structural steel sector is expected to evolve and grow…

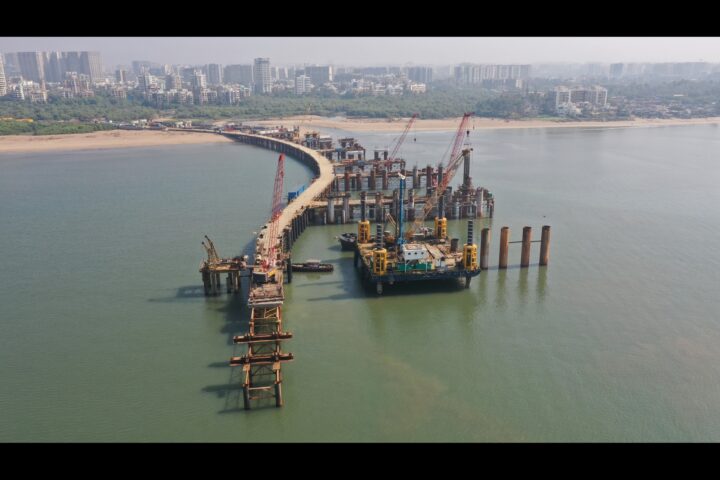

Once considered a background player, structural steel is now emerging as a prominent industry. These days, encountering structural steel is quite common whether you're walking along highways or driving through them. The reason being the country is going through a huge infrastructure development of the country. And to complete and support these huge infrastructure development structural steel are required. Structural steel is a category of steel used for making construction materials in a variety of shapes. Many structural steel shapes take the form of an elongated beam having a profile of a specific cross section. While driving it is quite common to come across structural steel being lifted by crane for construction of bridges, waiting for a crane for erection of power transmission or in completion of a wind mill projects. In fact, in modern construction structural steels are used in almost every type of structure including heavy industrial building, realty projects, tunneling project, infrastructure, bridge, tower, airport terminal, heavy industrial plant, warehouses, renewable energy plants, etc. Newspapers, TV channels and social media posts are brimming with astonishment on completion of challenging infrastructure projects like the Zoji-la-Tunnel, Chenab River Railway Bridge, Sela Tunnel, Atal Tunnel, Mumbai Trans Harbour Link, Dedicated Freight Corridor, Inland Waterway project, and many others. The realization of these long-lasting infrastructure projects would be inconceivable without the essential contribution of structural steel. The benefits of structural steel lie in its ability for components to seamlessly connect with one another, bearing loads and ensuring complete rigidity. With its high strength grade, steel structures offer reliability while requiring fewer raw materials compared to alternatives such as concrete or timber structures. Moreover, structural steels can be fabricated on-site, meaning they can be cut, bent, and assembled as needed to perfectly fit the project's requirements. The common assortment of shapes utilized in shaping infrastructure projects includes I-beams, Z-shapes, HSS-shapes (hollow structural sections), L-shaped cross-sections, C-beams, T-shaped cross-sections, flanged T rails, asymmetrical I-beams, bars, rods, and more. While some sections are produced through hot or cold rolling processes, others are created by welding together flat or bent plates. In the construction of bridges, various types of steel girders such as box girders, H-girders, truss girders, pipe arch girders, and Bailey bridges are commonly employed. Synergy Steels has recently launched stainless steel rebars and stainless steel bright bars. “Our most recent launch, stainless steel rebars are corrosion-resistant and durable, making them ideal for infrastructure and construction projects. These rebars provide enhanced structural integrity, longevity, and design flexibility while minimizing maintenance needs. Our wire rods serve as a vital raw material for the production of wires and bright bars. These wire rods are widely used in the construction and infrastructure sectors. In order to further expand our product range, we have recently introduced 5mm stainless steel wire rod across various grades. Known for their aesthetic appeal, our stainless steel bright bars are extensively used across various industries, including kitchens, home appliances, and consumer durables. Bright bars are processed to manufacture handles, shafts, etc, enhancing the visual appeal and functionality of a wide range of products. Our extensive range of fasteners encompasses 26-27 different types, making them versatile and suitable for a wide range of industries. These fasteners are known for their strength, durability, and corrosion resistance. They provide reliable and secure connections in industries such as construction and infrastructure development, ensuring the longevity and safety of assemblies,” says Anubhav Kathuria, Director at Synergy Steels. Goodluck India provides CDW tubes and ERW pipes to various industries including the automobile sector, solar and renewable energy sector, as well as the infrastructure sector. Additionally, the company supplies boiler and heat exchanger tubes to the energy sector. In the infrastructure vertical, Goodluck India specializes in fabricating steel bridges for railway and road projects. Notably, the company is a major supplier of steel bridges to the National High-Speed Rail Corporation for the Mumbai to Ahmedabad debut bullet train project.

Growing Market

The market for structural steel is steadily expanding at a steady pace. According to Modor Intelligence, the Indian structural steel fabrication market is estimated to be valued at USD 15.66 billion in 2023 and is expected grow to USD 23.77 billion in 2028 at a CAGR of 8.71% over the forecast period. The expansion in structural steel demand will stem from government expenditure on various construction projects such as airports, data centers, warehouses, fabrication shops for defense and military equipment, semiconductor and electronics parks. “

India's utilization of steel components in structures remains at a mere 20 percent, significantly lower compared to countries such as China, Taiwan, Japan, Australia, and the USA. This demand is on the rise, driven by design transitions initiated by green building structures and the adoption of lighter weight sections,” says M C Garg, Chairman, Goodluck India. The rising demand for structural steel has been further accelerated by the Government's Rs. 111 lakh crore National Infrastructure Pipeline Initiative (NIPI) extending until fiscal 2025. The government's focus on various sectors including housing, roads (Bharatmala), ports (Sagarmala), railways (DFCC, metros, bullet trains, RRTS), and airports (Udaan) has contributed significantly. Construction activities on roads and highways, particularly under the Ministry of Road Transport and Highways, have intensified, with expressways being constructed at a rapid pace. “The demand for structural steel in India is expected to experience significant growth in the coming years. This growth is likely to be fuelled by various factors such as the government's push on infrastructure development. With a number of upcoming projects, we see increased demand for structural steel in projects encompassing roads, bridges, railways, airports, and metro systems. Additionally, the expansion of industries such as automotive, manufacturing, power, and telecommunications is set to drive the need for structural steel.” says Anubhav Kathuria. Several key factors underscore the size and potential of this market, including the burgeoning construction sector driven by urbanization, industrialization, and government initiatives like Housing for All and the Smart Cities Mission.

Codes and Standards

Structural steel plays a crucial role in the construction industry, providing strength, durability, and flexibility to various structures. To ensure the safety and reliability of steel structures, adherence to specific codes and standards is essential as it ensure safety of occupants and users of buildings; quality assurance ensuring that the steel used meets the requires standards; interoperability as it provides common language of communication between all the stakeholders involved in any construction project. In India, several codes are followed to govern the design, fabrication, and erection of structural steel such as Indian Standard Code of Practice: IS 800; Indian Standard Code of Practice: IS 875; and Indian Standard Code of Practice: IS 2062 thereby promoting safe and sustainable development, ensuring the longevity and reliability of steel structures. Key codes utilized in India include the Indian Standard (IS) and American codes such as AISC. These codes prioritize safety by ensuring structures are capable of withstanding various loads and environmental factors. They also establish quality control measures to uphold high standards throughout the industry and promote consistency among architects, engineers, contractors, and inspectors. Adherence to these codes is frequently mandated by law, aiming to prevent unsafe structures and ensure compliance with regulations. IS codes, such as IS 800 and IS 875, outline design loads and construction procedures in India. It's important to recognize that these codes are subject to ongoing refinement. For instance, IS 1893 focuses on earthquake-resistant design, particularly crucial in India's seismic zones. Conversely, American codes like AISC 360 offer benefits like enhanced cost-effectiveness, practicality, and integration of established industry practices. The focus on maximizing steel efficiency in construction not only yields economic benefits but also helps reduce national resource wastage. A balanced approach that combines the utilization of American steel design codes for efficiency and IS codes for seismic considerations can be a prudent strategy in the construction sector.

Challenges & roadblocks

The fluctuation in steel prices poses a significant challenge for players in the structural steel industry. “We do understand that volatility in stainless steel prices, and more so in raw material costs, poses a significant challenge for our business and the industry at large. Any fluctuations in this regard directly impact various aspects of our operations, including production costs, raw material procurement, and finished goods export strategies, ultimately affecting our overall profitability,” says Anubhav Kathuria. In addition to the volatility in steel prices and raw materials, structural steel manufacturers encounter stiff competition from unorganized counterparts. These unorganized manufacturers not only produce inferior structural steels but also exhibit sluggish project execution. “Many major OEMs lack comprehensive experience and expertise, and are mostly with civil background. Consequently, projects are initiated without proper budgeting. These prices expected by OEMS and EPC for critical performance products are too low for us to supply. The other challenges we face are the entry barriers imposed by RDSO and Railways are not stringent and their approvals are not sacrosanct,” says M C Garg. M C Garg further list out other challenges such as managing positive cash flow which is consistently challenging due to inadequate payments from EPCs and OEMs; the lack of a credit facility for purchasing raw materials hampers the ability to scale operations and high logistics costs pose challenges for exporting goods; and due to extended conversion times for supplies, maintaining stocks becomes counterproductive, hindering additional borrowing or investment. Furthermore, project financing is unavailable from banks. “Financing options too come at a high cost and are not factored into pricing structures. The initial investments are substantial, leading to a depletion of allocated working capital when scaling up operations,” says M C Garg. Finally, but certainly not least, the industry grapples with a shortage of skilled manpower for both project execution and design. While the documentation of construction processes is gradually shifting towards BIM technology in the AEC (Architecture, Engineering, and Construction) sector, the integration of designing, detailing, and fabricating steel structures into digital modeling software hasn't fully reached vendors and designers working with steel. Consequently, there exists a gap between the design and fabrication workforce and specialized software tools.

Expectations from government

In India, the structural steel industry is emerging and steadily progressing. To fortify its burgeoning foundation, the industry requires government support. Given that structural steel is predominantly utilized in infrastructure projects, the industry anticipates support and incentives from the government. On this front, the government can play a crucial role in advancing the structural steel industry through various initiatives. This encompasses substantial investments in infrastructure development, particularly in bridges and buildings, which extensively employ structural steel, thus enhancing demand. Government backing for research and development in steel technology, corrosion prevention, and sustainability can spur innovation and enhance the industry's competitiveness. Establishing robust regulatory frameworks and building codes will ensure adherence to quality and safety standards. Moreover, the government can encourage skill development, enact favorable trade policies, provide incentives to steel manufacturers, and facilitate research partnerships.

A growing market

Structural steel finds application in nearly all infrastructure projects. The government has announced numerous infrastructure initiatives, many of which are currently in the commissioning and execution phases. Furthermore, the government's focus on infrastructure development, coupled with rising urbanisation and consumers' increasing demand for high-quality commercial structures, alongside government initiatives promoting green buildings, smart cities, and the ‘Make in India’ campaign, is anticipated to fuel the growth of structural in India.