Interview: Saurabh Marda, Co-Founder and Managing Director, Freyr Energy

The most significant advancement lies in technology-enabled financing solutions that streamline the entire customer journey. AI-powered risk evaluation has reduced loan approval times from weeks to hours

How have recent government policies and incentives reshaped investment patterns and innovation in India’s renewable energy sector?

The PM Suryaghar Mufti Bijli Yojana represents a watershed moment for India’s renewable energy landscape, particularly in addressing the residential segment that accounts for 25% of the country’s total electricity consumption. This initiative is fundamentally reshaping market dynamics by making rooftop solar accessible to middle-class households through substantial subsidies and streamlined processes. Financial inclusion has been achieved by integrating central and public sector banks into solar financing, democratizing access to clean energy solutions. Process simplification, through digital approval systems and single-window clearances, has reduced project timelines from months to weeks. This has accelerated investment, attracting significant private capital, with companies like Freyr Energy expanding operations across 40+ cities to meet growing demand. The residential solar market is now experiencing unprecedented growth, with installation costs becoming more affordable than ever. This policy-driven transformation is creating a virtuous cycle where increased demand drives technological innovation, manufacturing scale, and further cost reductions. From an investment perspective, the predictable policy environment and government backing have reduced perceived risks, leading to increased institutional investor participation and more favourable financing terms across the renewable energy value chain.

What breakthroughs in solar, wind, storage, or green hydrogen do you believe will drive the next wave of growth in India?

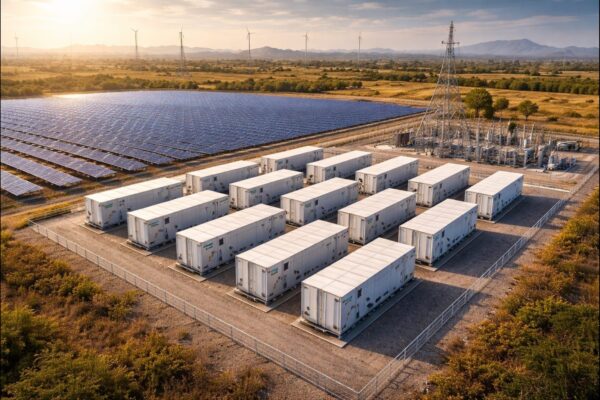

Energy storage is emerging as the game-changer for India’s renewable energy sector due to the convergence of declining battery costs and supportive policy frameworks. Lithium-ion battery prices have dropped by over 70% in the past five years, making distributed energy storage economically viable for both residential and commercial applications. Alongside this, the development of the India Energy Stack represents a paradigm shift toward intelligent energy management. This comprehensive digital infrastructure will enable decentralized grid integration, allowing DISCOMs to efficiently manage distributed solar and storage resources. It will also allow peer-to-peer energy trading, empowering prosumers to sell excess solar generation directly to neighbouring consumers, and dynamic load management, where AI-driven demand response systems optimize energy distribution in real time. These technologies address India’s dual challenge of meeting growing energy demand while maintaining grid stability. The integration of smart storage solutions with the India Energy Stack will enable higher renewable energy penetration while reducing dependence on fossil fuel-based peaking power plants. For companies like Freyr Energy, this technological evolution creates opportunities to offer comprehensive energy solutions beyond traditional solar installations, including integrated storage systems and energy management services.

With growing investor interest, what financing models or partnerships are proving most effective for scaling renewable projects in India?

The renewable energy financing landscape has undergone a remarkable transformation, with traditional banks now offering solar loans at competitive rates of 6.5-7%. This marks a significant shift from the past when renewable energy was considered a niche, high-risk investment category. The most significant advancement lies in technology-enabled financing solutions that streamline the entire customer journey. AI-powered risk evaluation has reduced loan approval times from weeks to hours. Seamless integration between solar companies, banks, and NBFCs has eliminated multiple touchpoints, while digital platforms now provide real-time pricing and financing options, enhancing the customer experience. Successful scaling requires collaborative partnerships, combining solar EPC companies that provide technical expertise and project execution, financial institutions that offer competitive financing products, and technology platforms that enable seamless customer onboarding and loan processing. These innovations have democratized access to solar financing, enabling customers across income segments to adopt renewable energy solutions. The result is a more inclusive energy transition that drives both environmental and economic benefits.

How is India’s push for local manufacturing of renewable components impacting costs, quality, and global competitiveness?

India has successfully established itself as a global leader in renewable energy component manufacturing, particularly in solar modules and inverters. Indian manufacturers now produce world-class components that meet international quality standards while maintaining cost competitiveness. Strategic policy interventions such as Production Linked Incentive (PLI) schemes have provided financial support for scaling manufacturing, while import duty structures have protected the domestic industry and ensured fair competition. Quality standards and certification requirements have maintained global competitiveness. This local manufacturing push has delivered multiple benefits, including reduced logistics costs, better quality control through proximity to end markets, and increased supply chain resilience by reducing dependence on international suppliers. It has also generated thousands of skilled manufacturing jobs across multiple states. Furthermore, Indian renewable energy components are increasingly being exported to international markets, positioning India as a global renewable energy manufacturing hub. This self-sustaining ecosystem supports India’s ambitious renewable energy targets while contributing to global decarbonization efforts.

In what ways are digital technologies – smart grids, AI, predictive analytics -transforming the way renewable energy is generated, stored, and distributed?

The India Energy Stack represents a comprehensive digital infrastructure that integrates smart grids, advanced metering, and energy storage systems, fundamentally transforming how energy is generated, consumed, and traded in India. Advanced grid technologies are enabling real-time demand prediction through AI algorithms that analyse consumption patterns to optimize energy distribution. Automatic redistribution of renewable energy based on grid conditions ensures dynamic load balancing, while predictive maintenance reduces outages and improves reliability. Digital technologies are also making distributed energy storage more intelligent, with AI determining optimal times for charging and discharging, providing frequency regulation and voltage support, and maximizing financial returns from stored energy. Pilot projects have already demonstrated successful integration, and widespread commercial deployment is expected within the next 5–10 years. For energy companies, these technologies create opportunities to offer value-added services beyond traditional energy supply, including grid stabilization, demand response, and energy optimization services.

What are the biggest challenges India must overcome – land use, grid integration, or policy stability – to achieve its 2030 renewable energy targets?

While India has made remarkable progress in renewable energy deployment, grid integration remains the most critical challenge for achieving 2030 targets. The intermittent nature of renewable energy requires sophisticated grid management capabilities that are still being developed. Ensuring policy consistency across federal and state levels is another major challenge. State electricity boards must align their procurement and grid management strategies with national renewable energy goals. Regulatory harmonization, such as standardized policies across states, would accelerate project development and reduce uncertainty, while implementation consistency is necessary to ensure ground-level outcomes match policy intent. State-level variations in net metering policies, approval processes, and grid connectivity norms create unnecessary hurdles. Addressing these challenges requires strengthened coordination between central and state governments, standardized implementation guidelines for renewable energy projects, enhanced investments in grid infrastructure, and consistent policy messaging to build investor confidence. Success in overcoming these challenges will determine whether India achieves its ambitious 2030 renewable energy targets while maintaining energy security and economic growth.

How do you see green fuels – such as green hydrogen and biofuels – shaping India’s transition toward a low-carbon, green economy in the next decade?

Biofuels represent the most realistic and scalable solution for decarbonizing India’s transportation sector over the next decade. They offer several advantages, including compatibility with existing infrastructure, economic viability using agricultural waste and energy crops, and the ability to deliver immediate carbon emission reductions. Green hydrogen, while more transformative, represents a longer-term opportunity. Its initial adoption is likely to be in industries such as steel, cement, and fertilizers, where it can replace fossil fuel-based processes. However, widespread adoption of green hydrogen requires significant investments in production, storage, and distribution infrastructure, and current costs remain high. The optimal approach involves a phased transition: near-term aggressive biofuel adoption across transportation (2025–2030), medium-term deployment of green hydrogen in industrial applications (2030–2035), and a long-term comprehensive green hydrogen ecosystem for transportation and industry (post-2035). This dual-track approach allows India to achieve immediate emission reductions through biofuels while building the foundation for a comprehensive green hydrogen economy. For energy companies, this presents opportunities across multiple value chains, from biofuel production and distribution to green hydrogen project development and industrial applications.

Tags