Interview: Iesh Dixit, Co-founder and CEO, Powerplay

Digitisation can cut construction milestone durations by 7–15% through faster decisions, reduced rework, and better sequencing, provided usage is disciplined. Site-friendly mobile tools, clean execution data, and integration with ERP/BIM enable clear ROI, predictive planning, ESG compliance, and more efficient, auditable project delivery by 2030

How much has digitisation shortened project timelines in real terms?

I’m usually cautious when someone asks for a single number. The outcome varies by project type, trade mix, and how disciplined the organisation is in daily use. Even so, the effects are measurable and tend to compound over time. Improved visibility reduces decision latency. Saving even a day on approvals – material substitutions or equipment changes, pulls forward dependent activities. Among mature Powerplay users, we typically see mid-single to low-double digit reductions in milestone durations, often in the 7–15% range. These gains show up most clearly in repetitive trades and finishing work, where rework and sequencing issues consume time. There’s also the impact of reduced rework. Construction productivity has lagged other sectors for years, and recent global data shows further declines. Earlier defect detection matters. Digitisation helps avoid the two-to-four-day loops that often occur when issues surface only during weekly inspections. In practical terms, a developer running multiple projects with mature digital execution can expect schedulable durations to shorten by roughly one to three weeks on a typical nine-to-twelve-month internal milestone, with a larger cumulative effect over the full project. The tool itself doesn’t create this outcome. Consistent, disciplined use does.

What design choices made Powerplay work for supervisors and labour teams?

Designing for construction sites is very different from designing for offices. Many of the decisions we made were cultural as much as technical. We focused on mobile-first actions that take seconds. Supervisors work under time pressure, often with dust, noise, and limited attention. Core workflows had to be quick: capture a photo, tag it, assign it. Long forms and deep menus break habits before they form. We leaned heavily on visual cues. Photos are the site’s primary language. Status chips and a small number of decision-driving fields are faster to scan than lists of text. Workflows were shaped around existing habits. Instead of forcing teams to abandon familiar practices, the system augments them – daily progress notes, site reporting, basic annotations. That lowers friction and reduces the political cost of adoption. Local language support and offline reliability were non-negotiable. Indian sites are linguistically diverse and often operate with weak connectivity. The app works offline and syncs reliably later, preserving evidence and continuity. We also kept interfaces role-specific: supervisors, planners, and managers don’t need the same surface area. A minimal UI for crews and richer views for planners keep people focused on their actual work. These choices mattered. In field trials, the gap between download and first-week active use was far smaller than with desktop-centric tools. That early adoption gap is often what determines long-term ROI.

When will AI move construction management from reporting to prediction?

The shift is closer than many expect. We see operationally useful prediction emerging within one to two years, provided a couple of conditions are met. Ground data has to be clean and consistent. Daily progress, tagged photos, timestamped updates, and structured issue categories are prerequisites. Feature engineering also needs to reflect construction realities. Useful predictors are contextual – trade pace under local weather, supplier lead times, historical drift between planned and as-built conditions on similar sites. In pilots, short-horizon forecasts of seven to twenty-one days are already accurate enough to support mitigation planning.

What hard RoI metrics justify digitisation for a developer’s P&L?

Executives ultimately look for outcomes that show up clearly in the P&L and balance sheet. One of the most tangible is improved accuracy in material usage on site. When consumption is captured daily against actual work done, leakage becomes visible. That directly reduces excess ordering and materially lowers theft and pilferage, which are otherwise written off as “site variance.” Rework reduction is one. Earlier issue detection and enforced checklists typically lower rework costs by 3–5% in finishing trades, which translates into meaningful savings on large residential projects. Site overheads also improve. Better sequencing reduces idle labour and equipment time. Even a 2–3% gain in utilisation lowers operating cost per unit delivered. Clear, time-stamped records reduce disputes and claims, which protects margins and cuts down legal costs. Productivity gains matter as well. When supervisors can manage more area or more packages with the same headcount, labour cost per square foot comes down. There’s also a quieter but real saving: teams spend far less time compiling daily, weekly, and monthly reports, because much of the data is already structured and ready. In some pilots, we often build a simple ROI model with the PMO and finance teams. Mapping rework reduction, faster bill certification, and productivity gains to margin impact tends to resonate more than polished vendor decks.

How important is integration with BIM, ERP, and digital twins?

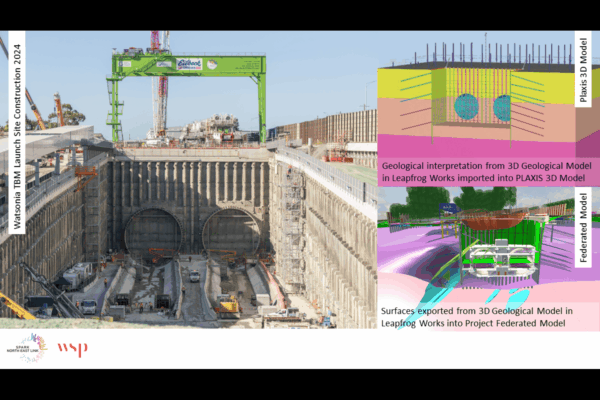

Our focus has always been on capturing execution reality at the source: photos, quantities, progress, approvals, and issues in a way that works for supervisors and foremen. That site-level data is then cleaned, structured, and collated so it can meaningfully feed upstream systems. ERP integration is especially critical. When verified site progress flows directly into financial systems, cost recognition, subcontractor billing, retentions, and inventory reconciliation become far tighter. The ERP remains the system of record, but it is no longer dependent on delayed or manually compiled inputs. The same applies to BIM and digital twins. Models and twins gain real value only when they are continuously updated with what was actually built, when, and under what conditions. Our role is to make that execution data reliable and easy to integrate, rather than forcing site teams to work inside tools that were never designed for them.

Will regulation and ESG accelerate site-level digitisation?

Regulation and ESG are already pushing digitisation from optional to necessary. Disclosure frameworks such as SEBI’s BRSR require verifiable evidence, much of which originates on site – waste data, safety records, energy use during construction. Digitally captured data is far easier to compile and audit. Safety and labour compliance increasingly demand machine-readable proof of briefings, PPE issuance, and labour hours. Paper struggles to meet that standard. As sustainable materials and embodied carbon tracking gain importance, traceable procurement and installation data becomes essential. Regulation raises the baseline for acceptable evidence. ESG creates commercial upside for those who can demonstrate compliance. Manual processes don’t scale under these pressures.

How will digitisation fundamentally change project delivery by 2030?

By 2030, execution will look different in a few core ways. Schedules will become living systems, updated continuously with site data and short-horizon forecasts rather than static plans. A large part of office-side planning, reporting, and coordination work will be augmented by AI, not replacing planners, but removing much of the manual reconciliation and follow-up that consumes their time today. Billing, quality, and safety will rely on auditable decision trails built from time- and location-stamped evidence, reducing friction and disputes. Repeatable systems will scale more easily. Digitisation, BIM, and digital twins will allow consistent quality even with less experienced teams, while making expert oversight more leverageable. Adoption won’t be uniform. Large developers and infrastructure players will move first, with others following as costs fall and standards mature. The overall effect will be a sector that delivers with greater predictability, safety, and capital efficiency.

Tags