Interview: Aashutosh Aggarwal, Chief Executive Officer, Simon India

Transporting hydrogen in its pure form is expensive, but converting it to green ammonia provides a more efficient and scalable route for storage and logistics.

What prompted Simon India’s entry into green hydrogen and green ammonia, and how does the company plan to differentiate itself in the increasingly competitive new energy sectors?

Simon India’s entry into green hydrogen and green ammonia is a natural extension of our commitment to energy transition. Having long served the fertiliser, chemicals, and oil & gas sectors, we recognised the global shift from conventional fuels to renewables, and the growing need to replace grey hydrogen with cleaner alternatives. Green hydrogen will play a pivotal role across various applications – transportation, bulk material handling, ammonia production, and more. We differentiate ourselves through a combination of deep domain process expertise, a strong digital EPCM model, and strategic collaborations across the whole value chain. This allows us to offer both thought leadership and end-to-end engineering, procurement, construction, and technical services – positioning Simon India as a comprehensive and forward-looking partner in the new energy landscape.

While many companies have announced green hydrogen roadmaps, only a few have progressed to on-ground execution. In your view, where are the real, bankable opportunities emerging today?

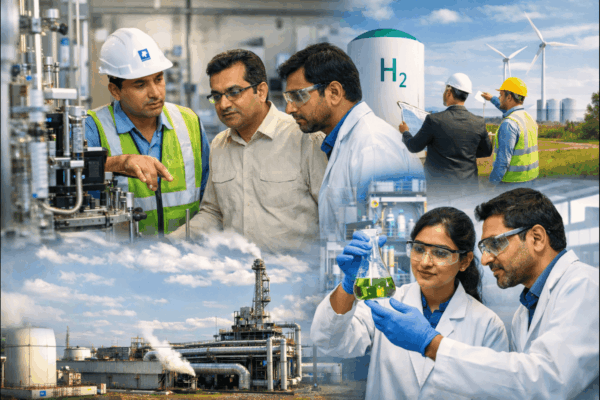

While there is significant interest in green hydrogen, the real, bankable opportunities are emerging where renewable power availability, scale, and cost efficiency converge. Today, green hydrogen in India costs almost twice as much as grey hydrogen, so improving commercial viability is key. India’s strong renewable energy base – over 275 GW – creates a natural advantage for producing hydrogen via electrolysis, especially when integrated with grid balancing solutions. Another major opportunity lies in developing domestic electrolyser manufacturing. Currently, most gigawatt-scale electrolysers are imported, which drives up project cost. Building local manufacturing capacity will significantly reduce capex and accelerate deployment. Additionally, transporting hydrogen in its pure form is expensive, but converting it to green ammonia provides a more efficient and scalable route for storage and logistics. Localised ammonia cracking and fuel cell applications can then enable use across mobility and industrial sectors. In short, the near-term bankable opportunities lie in renewable co-location, domestic electrolyser manufacturing, and green ammonia as a transportable energy carrier – these will form the backbone of commercially scalable green hydrogen adoption in India.

Green hydrogen and green ammonia require integration of electrolysers, renewable power, nitrogen generators, ammonia synthesis loops, and storage. How is Simon India building or partnering for competence across the full process chain?

Simon India approaches green hydrogen and green ammonia not as a single-technology intervention, but as a full value-chain integration challenge. Simon India is partnering with leading global licensors of Proton Exchange Membrane (PEM) and alkaline electrolysers, while leveraging our in-house engineering strength to carry out design engineering and develop the complete package including BOP and execute detailed engineering for on-ground implementation. On the renewable energy side, we are in connect with solar and wind developers to ensure stable and optimised power input, as the continuity of green hydrogen generation is critical for efficient downstream ammonia synthesis. Our long-standing expertise in ammonia comes from decades of work in the fertiliser sector as part of the Adventz Group, giving us deep process know-how in ammonia loop design, refrigeration and storage systems. A key differentiator is our digital layer, where platforms such as Proton, Sphere and SmartINV enable AI enabled real-time monitoring, predictive insights and managing processing across the entire value chain. This integrated EPCM and digital capability allows us to provide end-to-end project delivery – from electrolyser integration through to ammonia synthesis and storage – positioning Simon India as a strategic partner for scalable green hydrogen and green ammonia ecosystems in India.

What are the key steps needed to improve electrolysis efficiency and make green hydrogen production more cost-effective at scale?

Improving electrolysis efficiency and lowering the cost of green hydrogen requires optimisation across both energy supply and system design. The first and most significant factor is the cost and continuity of renewable electricity. While solar and wind tariffs in India have fallen to the ₹2.5–3 per unit range, standalone solar does not ensure continuous power. Hybrid models – such as solar–wind or solar–hydro combinations – are now helping achieve longer operational hours, but further reducing renewable power costs toward the ₹1–1.5 range will be essential for cost-effective hydrogen production. The second priority is scaling electrolyser capacity. Current installations in the 10–200 MW range are suitable for pilots, but large-scale hydrogen production will require gigawatt-scale electrolysers manufactured domestically to reduce capital costs and build economies of scale. Water usage efficiency is another critical area. Electrolyser feedwater must be highly purified, and the cost of treating and recycling industrial wastewater needs to fall to make large-scale plants viable. Finally, skilled operations and maintenance (O&M) capabilities must be strengthened. Advanced digital tools, including AI-driven predictive maintenance and process optimisation, can help reduce lifecycle costs by improving reliability and extending equipment life. These are some of the areas where Simon India is actively developing its thought leadership and exploring modular solutions to make green hydrogen more scalable and economically competitive.

Which sector is likely to see the fastest adoption of green hydrogen technology, and why?

The sectors most likely to adopt green hydrogen at scale in the near term are those where decarbonisation impacts are strongest. The steel industry is expected to move first, particularly as export markets like Europe introducing carbon border adjustment mechanisms. To remain competitive, Indian steel producers will need to replace grey hydrogen and coal-based reduction processes with cleaner alternatives, making green hydrogen an important pathway. The mobility sector will also emerge as a major adopter, especially for heavy-duty transport and industrial vehicles. While battery-based EVs are growing, hydrogen fuel cells offer longer range, faster refuelling, and fewer challenges around mineral sourcing and battery disposal – making them more suitable for commercial fleets and long-haul applications.

Fertilisers form another key opportunity, as ammonia, a major input for this sector, is directly derived from hydrogen. India imports a significant volume of ammonia, so green hydrogen-based ammonia production can support both decarbonisation and import reduction. Additionally, ammonia is gaining relevance as a potential bunker fuel for shipping and as a means of transporting hydrogen more safely and efficiently. Refineries will eventually transition too, but the shift may be slower because they already produce grey hydrogen internally. Over time, as emissions reduction targets tighten, green hydrogen will increasingly displace conventional hydrogen in this sector. Together, these sectors – steel, mobility, fertilisers, and eventually refining – represent the strongest near- and medium-term drivers for green hydrogen adoption.

What are the challenges to industrial adoption of green hydrogen, and what policy incentives are needed to drive scale in India?

Industrial adoption of green hydrogen is still in its early phase, and the transition requires strong policy and financial support. At present, the cost of producing green hydrogen in India is around $4.5–5 per kg – nearly double that of grey hydrogen – making large-scale commercial deployment a bit of challenging. To bridge this gap, long-term policy certainty and capital support are essential. One key requirement is firm off-take commitments. Whether from government or private industry, long-term purchase agreements (10–25 years) will provide investors and developers the confidence to build large integrated green hydrogen and green ammonia facilities. Additionally, capital subsidies and production-linked incentives can help bring down project costs and make green hydrogen price-competitive with conventional fuels. If policies ensure predictable demand and reduce upfront investment burden, the cost of green hydrogen can gradually move closer to $2/kg, enabling industrial-scale adoption across sectors such as steel, fertilisers, and heavy mobility. Together, these steps will be critical in accelerating India’s green hydrogen and green ammonia ecosystem.

What global best practices can we adopt from countries that are currently leading in this space?

Countries that are leading in green hydrogen and green ammonia are placing strong emphasis on Localised sourcing of electrolyser materials, advanced monitoring, and participative manufacturing models. One key best practice is the use of AI-based plant monitoring and predictive maintenance, which helps optimise uptime and reduce operating costs. Simon India is already providing services in integrating AI-led performance and maintenance systems into project delivery. Second, global leaders have adopted Industry 4.0 standards, where IoT-enabled sensor networks and advanced instrumentation are standard rather than optional. Ensuring these digital layers are embedded from the design stage will be critical for efficiency and long-term operational reliability. Third, the use of digital twins – virtual plant models that allow simulation, parameter testing, and performance optimisation before commissioning – has proven highly effective in improving plant efficiency and reducing execution risks. Finally, joint ventures with global technology suppliers can accelerate domestic manufacturing of key components, such as electrolyser stacks or automation systems, helping India build a stronger supply chain and emerge as a competitive global production hub.

How does Simon India envision its role in scaling green hydrogen and green ammonia infrastructure in the coming years? What steps, technologies or strategic capabilities is the company developing to support this transition?

Simon India sees itself playing a pivotal role in accelerating the scale-up of green hydrogen and green ammonia infrastructure, both in India and globally. Our objective is to be a full-lifecycle partner—from pilot projects to large commercial-scale facilities. We have developed strong in-house capabilities to deliver end-to-end FEED, EPCM, and project execution, giving clients a single point of responsibility for e2e integrated solutions. A key enabler of this scale-up is our digitally enabled project management ecosystem, including our proprietary platform Proton SI, which functions much like an “air-traffic controller” for complex multi-stakeholder projects. It ensures seamless collaboration, transparency, and clarity across global teams, engineering partners, and clients – irrespective of geographic or language barriers. We are also actively collaborating with leading research institutions in India and internationally to bring emerging technologies – such as next-generation electrolysers, catalysts, and ammonia synthesis systems – from laboratory scale to industrial implementation. By helping commercialise these innovations locally, we aim to build a strong domestic technology and manufacturing base. Finally, as India positions itself as a future hub for green energy solutions, Simon India intends to export its EPCM expertise to international markets, supporting global decarbonisation efforts. In essence, our strategic focus is on integrating technology leadership, digital execution excellence, and collaborative innovation to drive the green hydrogen and green ammonia transition at scale.

Tags