India’s warehousing boom – Unlocking the paradigm shift in industrial real estate

by Anshuman Magazine, Chairman & CEO – India, South-East Asia, Middle East & Africa, CBRE

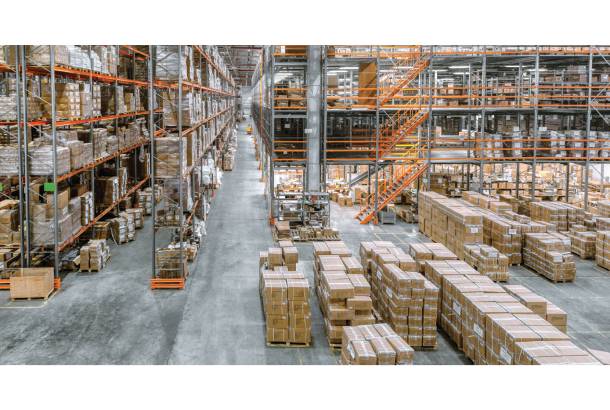

India’s rise as a global economic powerhouse is transforming its warehousing landscape into a dynamic, future-ready sector. Driven by booming industrial and logistics demand, the surge in e-commerce, and a supportive policy environment, the warehousing industry is witnessing unprecedented growth and diversification…

India’s growing prominence as a global business destination has created a paradigm shift in the warehousing segment. As the country continues to sail on the high tides of technological innovation, evolving digital landscape, and shifting consumption behaviour, the warehousing is reaping the benefits, thus embarking on high growth trajectory.

At the forefront of this lies the strong performance of the Industrial & Logistics sector, that translated into increased demand for warehouses across the country. Notably, the Industrial & Logistics sector recorded a remarkable 40% year-on-year growth in the January–March 2025 quarter, with leasing activity across the top eight cities – Delhi-NCR, Bengaluru, Mumbai, Hyderabad, Chennai, Pune, Kolkata, and Ahmedabad – reaching 12.1 million sq ft. As the country solidifies its position as a global manufacturing and consumption hub, the warehousing industry continues to step-up with agility and scalability, transforming into a value-generating asset class.

Diversified demand: A broader base for resilience

At the core of this transformation lies the diversification of demand. Third-party logistics (3PL) providers have emerged as the largest occupiers of warehousing space, accounting for 31% of total leasing activity in Q1 2025. With changing buyer & seller sentiment amidst a dynamic data driven economy and evolving retail supply chain, the e-commerce sector has tripled its space take-up in the same period, thus providing significant forward thrust to the warehousing demand. Together, these factors have impacted the warehousing segment significantly, shifting expectations towards faster turnarounds, smart infrastructure, and proximity to key consumption centers.

Importantly, growth is not limited to these verticals. Engineering and manufacturing players make up 17% of leasing activity, while the auto and FMCG sectors account for 8% and 5% respectively. This broader spectrum of demand is making the warehousing sector more resilient, more future-ready, and less dependent on any single demand stream.

The explosive growth of e-commerce has had a cascading effect on the logistics and warehousing ecosystem. As consumer expectations evolve – especially for same-day and next-day deliveries – companies are racing to build robust last-mile delivery systems. This has led to the development of regional fulfilment centers, even in Tier 2 and Tier 3 cities, as retailers aim to reach the end-user faster and more efficiently.

This shift is encouraging not just physical expansion, but also qualitative upgrades in warehousing – such as enhanced automation, temperature-controlled storage, and better inventory management systems. The outcome is a logistics landscape that is not just larger, but also significantly more sophisticated.

Policy reforms and infrastructure as enablers

A supportive policy framework has been essential to accommodate this escalating demand. Notably, the implementation of the Goods and Services Tax (GST) has played a pivotal role in establishing a unified national market. This has empowered organizations to streamline their warehousing infrastructure, enhance efficiencies across state borders, and mitigate logistical redundancies. Simultaneously, India’s infrastructure ambitions are coming to life. Large-scale initiatives such as the National Infrastructure Pipeline (NIP) and PM Gati Shakti are enhancing multimodal connectivity – allowing for smoother movement of goods across regions. In parallel, initiatives like Make in India and the Production Linked Incentive (PLI) scheme are accelerating industrial activity, especially in sectors like electronics, pharma, auto, and FMCG. These sectors, in turn, are partnering with 3PL players to develop tailored warehousing solutions, unlocking demand for more agile and efficient infrastructure.

From metros to new growth hubs: The geography of expansion

As demand surges, India’s warehousing footprint is expanding well beyond the traditional metros. Delhi-NCR, Hyderabad, and Bengaluru remain dominant, collectively accounting for nearly 60% of total industrial leasing, with Delhi-NCR alone absorbing 3.7 million sq ft in Q1 2025, or nearly 30% of national leasing. These figures reaffirm the continued strength of major urban centers.

However, the real story is the emergence of new regional hotspots. Cities like Pune and Chennai are fast evolving into strategic distribution hubs. This shift signifies a structural change – from metro-centric warehousing models to distributed logistics networks that align more closely with regional consumption and production trends. Supporting this decentralization is India’s ongoing infrastructure development – new expressways, dedicated freight corridors, and multimodal logistics parks are making Tier 2 and Tier 3 cities more attractive for large-scale warehousing investments.

Defining forces: Smart, sustainable, and policy alignment

As the sector moves forward, its trajectory will be shaped by three defining forces: technology, sustainability, and policy alignment.

- Smart warehousing through technology: The future lies in automation and data-driven operations. Technologies such as robotics, warehouse management systems (WMS), and the Internet of Things (IoT) are becoming standard in new facilities – especially for sensitive sectors like pharmaceuticals and perishables. These tools are improving real-time visibility, accuracy, and efficiency across the supply chain.

- Green is the new standard: Environmental, Social, and Governance (ESG) practices are becoming a competitive imperative. Warehouses powered by solar energy, with rainwater harvesting and sustainable building materials, are gaining traction across the industry. Green infrastructure is no longer just a value-add – it’s a key decision-making factor for both occupiers and investors.

- Collaborative policy and public-private partnerships: Increased alignment between state warehousing policies and national logistics strategies is streamlining development. Public-Private Partnership (PPP) models are unlocking land parcels, speeding up regulatory approvals, and expediting the creation of vital logistics infrastructure. These collaborations are essential for scaling sustainably and efficiently.

Conclusion: Building capacity and capability for the future

India's warehousing sector has reached a critical inflection point, transcending mere capacity expansion to necessitate the development of intelligent, sustainable, and adaptable ecosystems. This evolution is intrinsically linked to India's aspiration of achieving a $7 trillion economy by 2030. Bolstered by consistent returns, extended lease agreements, and increasing transparency, the sector maintains its appeal for substantial institutional investment, thereby catalyzing innovation, growth, and the generation of enduring value.

In 2025, this momentum is expected to accelerate, driven by high-quality supply, strong demand for distribution hubs, and rapid growth in e-commerce leasing, particularly in the quick commerce segment. Third-party logistics (3PL) players will remain key occupiers, while sectors like engineering & manufacturing, FMCG, and e-commerce broaden the leasing landscape. At the same time, institutional investor-backed developers are set to deliver a larger share of new projects – marking a shift toward more resilient, future-ready warehousing infrastructure across India.