How Changes in GST Slabs Will Reshape the Indian Infrastructure Industry

by Tejasvi Sharma, Editor-in-Chief, EPC World

In September 2025, India witnessed one of the most consequential tax reforms since the inception of the Goods and Services Tax (GST) in 2017. The GST Council’s decision to rationalise the rate structure – abolishing the erstwhile 12% and 28% slabs and consolidating the system into a streamlined 5% and 18% framework, with a 40% band reserved for luxury and sin goods – marks a decisive turning point for the infrastructure and real estate ecosystem. By easing the fiscal burden on critical construction inputs such as cement, steel, tiles, marble, and granite, the reform promises to trigger a new wave of competitiveness, affordability, and long-term resilience across the sector.

Lower Input Costs: Cement, Steel, and Bricks at the Core

Cement, the lifeblood of infrastructure, has historically been taxed at the punitive rate of 28%. Its reclassification to the 18% slab immediately translates into tangible cost reductions – an estimated ₹25–30 per 50 kg bag. In project economics, this equates to a 4–5% decline in overall construction costs, a relief that reverberates across both public infrastructure projects and private housing developments.

Steel, bricks, and allied construction materials have similarly been shifted downward, some to as low as 5%, further lightening the cost burden. Developers, EPC contractors, and infrastructure majors are therefore better positioned to undertake ambitious projects without the drag of excessive tax overheads. For a nation pursuing accelerated urbanisation and smart city development, such fiscal breathing space is not merely an accounting adjustment – it is a growth catalyst.

Affordable Housing and the “Housing for All” Imperative

Perhaps the most immediate and socially impactful outcome of the GST restructuring lies in the housing sector. Affordable housing, long beset by high construction costs and squeezed margins, stands to benefit significantly from the tax relief on core materials. Developers can now pass on savings to end-buyers, creating a visible 2–4% drop in property prices in the mid and affordable segments.

This reform aligns seamlessly with the government’s flagship Housing for All mission. As middle-class families gain greater access to affordable homes, the multiplier effect on consumption, mortgage growth, and allied services (furniture, retail, logistics) strengthens. By lowering the entry barrier for millions of first-time buyers, the new GST regime not only fosters inclusivity but also generates a powerful socioeconomic dividend.

Infrastructure Investment and Capex Revival

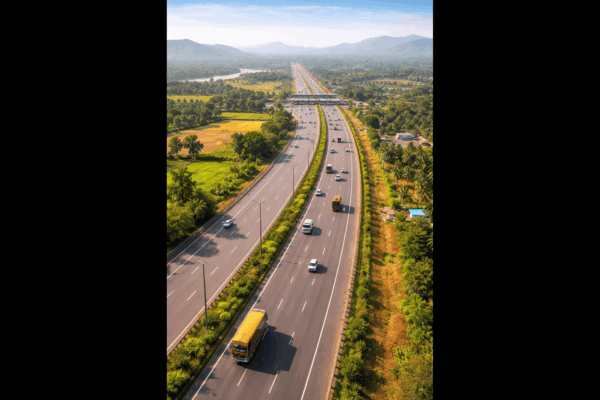

The infrastructure industry thrives on capital expenditure, yet project viability often hinges on the balance between input costs and expected returns. The GST rationalisation improves project feasibility by unlocking higher margins and easing working capital pressures. EPC players can now bid more competitively on government tenders for roads, bridges, metro networks, and industrial corridors, confident that input tax credit (ITC) flows and reduced tax incidence will protect their profitability.

This comes at a time when the Reserve Bank of India has already forecast a 21.5% jump in private capex for FY 2025–26, with infrastructure and power leading the surge. Tax relief on building materials adds momentum to this investment cycle, catalysing both greenfield projects and brownfield expansions. The reform thus synchronises fiscal policy with economic intent, spurring employment, innovation, and global investor confidence.

Renewable Energy and Sustainable Infrastructure

The rationalisation also dovetails with India’s clean energy commitments. By slashing GST on solar modules and wind turbine components from 12% to 5%, the government has reduced capital costs by approximately 5%. This reduction directly supports the ambitious target of achieving 500 GW of non-fossil capacity by 2030. Lower project costs will make renewable energy tariffs more competitive, thereby accelerating adoption and boosting infrastructure for grid-scale solar parks, hybrid wind projects, and rooftop installations.

The synergy between tax policy and sustainability demonstrates a future-oriented governance approach – where fiscal levers are consciously aligned with climate resilience and environmental priorities.

Compliance Simplification and Predictability

Beyond the material savings, the simplification of GST slabs itself represents a structural victory. By moving to a dual-rate system, businesses now face less ambiguity, reduced compliance burdens, and fewer disputes with tax authorities. Predictability in taxation encourages long-term planning and reduces litigation costs, which historically drained bandwidth and financial resources from infrastructure companies.

For large EPC firms managing multi-state projects, this uniformity eliminates unnecessary complexities and facilitates smoother cash flows across supply chains. For SMEs in the construction ecosystem, the reduction in compliance overheads is nothing short of transformative.

Wider Economic Multipliers

Economists consistently emphasise that infrastructure is the backbone of national growth, with one rupee invested in the sector generating up to 2.5 times in GDP impact. By lowering the tax burden, the GST reforms amplify this multiplier effect. Lower project costs translate into faster execution, which in turn boosts employment, stimulates demand for raw materials, and accelerates urban development.

In the longer term, these reforms create an enabling environment for public-private partnerships (PPPs), foreign direct investment in construction, and domestic innovation in building technologies. The new GST structure thus acts as a fiscal stimulant at precisely the juncture when India needs to consolidate its position as the world’s fastest-growing large economy.

The Road Ahead

While state-level duties and levies remain a potential counterweight that could dilute the benefits of GST rationalisation, the broader outlook remains strongly positive. For infrastructure developers, the reforms provide an unparalleled opportunity to reset project economics, boost affordability, and harness capital efficiency. For policymakers, the move reinforces India’s commitment to regulatory predictability and investment-friendly frameworks.

Most importantly, for citizens, the tangible outcomes will manifest in the form of cheaper housing, better connectivity, cleaner energy, and faster delivery of infrastructure that underpins daily life.

Conclusion

The restructured GST slabs are more than a tax reform; they are a growth enabler for the entire Indian infrastructure industry. By cutting costs, stimulating demand, and simplifying compliance, the reform paves the way for a more competitive, sustainable, and inclusive future. As India marches toward its $5 trillion economy ambition and pursues climate-smart growth, this fiscal recalibration may well be remembered as a watershed moment in the nation’s infrastructure journey.

Tags