Green ammonia: India’s path to execution and the strategic role of EPC

by AK Tyagi, Founder, Chairman & Managing Director, Nuberg Engineering

India’s green energy transition has gained momentum with green ammonia emerging as a key enabler of the hydrogen economy. Backed by the National Green Hydrogen Mission, the country is positioning itself to meet domestic decarbonisation goals and tap global demand. Yet, success depends on advanced technologies, robust EPC capabilities, and compliance with evolving international certification standards

India’s green energy story is steadily advancing, presenting a significant opportunity for transformation. With the approval of the National Green Hydrogen Mission in January 2023 and an initial outlay of ₹19,744 crore, the country has set its sights on producing at least 5 million metric tonnes of green hydrogen annually by 2030. Among its most promising derivatives is green ammonia, often considered the most efficient hydrogen carrier because of its high hydrogen content (17.6% by mass), which makes it ideal for large-scale transport and storage.

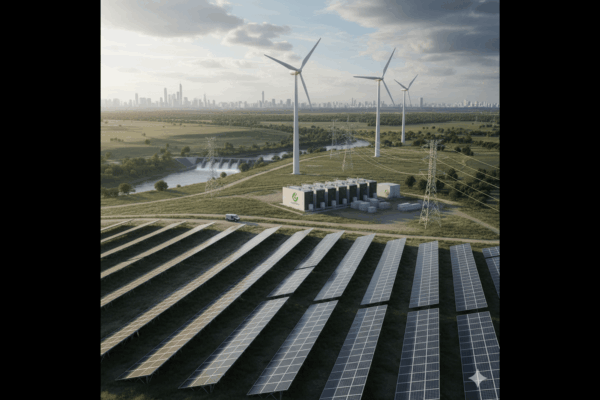

Yet, producing green ammonia is a complex undertaking that demands advanced technology, meticulous processes and substantial capital investment. Electrolysers powered by renewable energy consume nearly 50–55 kilowatt hours of electricity for every kilogram of hydrogen. Since one tonne of ammonia contains about 176 kilograms of hydrogen, producing just a single tonne requires close to 9–10 megawatt hours of electricity. When additional requirements such as nitrogen separation, compression, synthesis and storage are factored in, the figure rises to around 10–12 megawatt hours per tonne. These demands make site selection, renewable sourcing strategies, and integration with grid and storage systems critical to project success.

Alongside these technical challenges, India is now preparing for evolving international market standards. The European Union, for example, now requires carbon intensity to be capped at just 0.61 tonnes of CO₂ per tonne of ammonia for imports to qualify as renewable. Japan, too, is advancing certification norms as it scales up hydrogen and ammonia co-firing projects. India’s competitiveness will hinge on embedding robust MRV systems into plant design from day one, as these are the passport to global acceptance.

Global demand signals underline the urgency. The EU’s REPowerEU plan envisions 10 million tonnes of renewable hydrogen production and an equal volume of imports by 2030, with ammonia as a key enabler. Japan has set a target of 3 million tonnes of hydrogen supply by 2030, much of it through imports, while also advancing ammonia co-firing in coal power plants. Even the shipping industry is experimenting with ammonia as a future fuel, guided by the International Maritime Organization’s 2023 greenhouse gas strategy. Together, these shifts point to a surge in global demand for ammonia in the coming decade.

For India, this presents a twofold opportunity: reducing import dependence and building an export engine. Domestically, replacing fossil-based ammonia in fertilizer production with green alternatives can significantly cut emissions while aligning agriculture with sustainability goals. At the same time, scaling up production capacity positions India as a supplier to global markets keen for low-carbon fuels, strengthening its economy and reinforcing its leadership in the clean energy transition.

Here, the engineering, procurement, and construction (EPC) sector will be pivotal. The challenge is not only to build plants but to design them for the future. Plants that align with renewable generation profiles, incorporate high-efficiency air separation units with heat recovery and deploy modular electrolyser systems for phased expansion. Locating such facilities near ports with strong logistics, rail links, and reliable power supply can further lower costs and accelerate India’s readiness to serve global export markets.

This vision is already taking shape through the efforts of Nuberg Green Energy. Having delivered India’s first hydrogen fuelling station in Vadodara and multiple projects across the Middle East and Europe, the company has proven expertise in hydrogen and its derivatives, particularly green ammonia. By combining technology-neutral process engineering with compliance readiness and India’s cost-effective execution capabilities, Nuberg is well-positioned to replicate global success within the country.

In addition, the company has entered into a strategic collaboration with EDL Anlagenbau Gesellschaft mbH for the development of next-generation solutions in green ammonia, green methanol, sustainable aviation fuels, and other hydrogen derivatives. Through such collaborations, EPC firms can help India meet its domestic decarbonisation goals while also aligning with international market standards. Nuberg’s integrated methodology spanning the entire EPC cycle from concept to commissioning ensures sustainable, future-ready plant solutions for industrial clients worldwide.

Ultimately, the success of India’s green ammonia ambition will hinge on three factors: the speed of project execution, the robustness of certification compliance, and the ability to align engineering design with both domestic needs and export opportunities. For EPC companies, this is not merely a business prospect, it is an opportunity to secure India’s place at the heart of the global clean energy value chain.

Tags