Interview: Jigar G Raj, Promoter, KAGI Energy & Infra

As projects age and undergo refinancing or ownership changes, asset reliability, uptime and predictable generation become key decision factors for investors and lenders

What new technologies or products are you showcasing, and how do they improve efficiency, cost or performance?

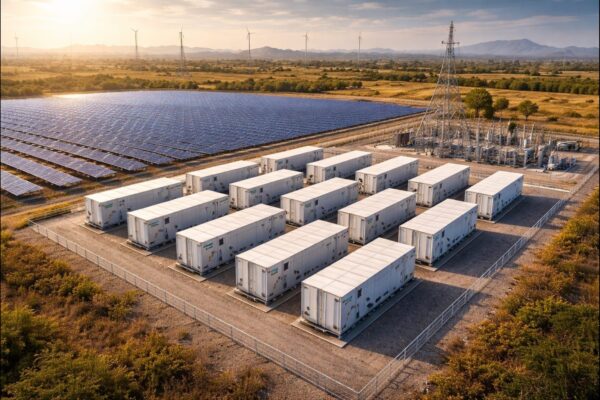

We as KAGI Group are showcasing our expertise in execution, consulting and designing of various scale projects hybrid RE + BESS configurations, and digital plant optimisation. The emphasis is on higher CUF, better land productivity and grid-friendly generation, aligned with CEA and MNRE’s push for firm and dispatchable renewables. Storage-integrated and hybrid solutions are now becoming mainstream, particularly in Gujarat, where policy actively supports such configurations. We also have a dedicated vertical focused on innovation and development in Electric Mobility and Charging infrastructure, aligned with central schemes such as FAME and PM-E-Drive.

Solar panel prices have fluctuated lately. How are raw material costs and global supply dynamics impacting pricing and competitiveness in India?

Solar module pricing continues to be influenced by global raw material dynamics, especially polysilicon, wafers and solar glass, where supply chains remain highly concentrated. While volatility has eased compared to earlier years, dependence on imports still exposes India to international price swings and logistics risks. The Union Budget 2026 has taken targeted steps to address this, notably by removing customs duties on key solar glass inputs and capital equipment for battery and clean-energy manufacturing, while significantly increasing MNRE allocations. These measures directly reduce input costs, improve domestic manufacturing competitiveness and strengthen supply-chain resilience. Combined with PLI support and ALMM, the budget signals a clear shift from price-led imports to stable, bankable and domestically anchored supply, which will help moderate price volatility, improve execution certainty and enhance India’s competitiveness in the medium to long term.

What progress are you making in manufacturing localisation in India? How critical is it for cost stability and supply security?

Manufacturing localisation in India has moved from intent to execution. With PLI schemes, ALMM and continued budgetary support, the country has created credible capacity across modules, cells and parts of the upstream value chain, significantly improving supply security and price predictability for developers and utilities. From my experience as a Sector Expert and Consultant with the Energy & Petrochemicals Department (EPD), Government of Gujarat, working alongside GUVNL, GPCL, DISCOMs and other departments, it was evident during the drafting of the Gujarat Integrated Renewable Energy Policy-2025 that stakeholders consistently flagged supply disruptions, cost volatility and import dependence as key risks. These insights directly shaped the policy’s emphasis on integrated planning, manufacturing enablement and long-term ecosystem development. Local manufacturing is therefore critical not only for stabilising costs and ensuring timely availability, but also for preparing India for the next phase of the transition, including solar PV recycling and circular-economy integration, which will become increasingly important as capacity scales.

In a market with rising competition, how do your solutions stand apart?

Our differentiation lies in policy-aligned project structuring, strong techno-commercial depth and long-term asset thinking. We design solutions keeping future grid norms, storage integration and end-of-life considerations in mind, fully aligned with prevailing regulations and India’s Panchamrit commitments, ensuring projects remain viable and compliant over their entire lifecycle. What truly sets us apart is our end-to-end capability. We operate across consulting, design, execution and operations, and also extend into electric mobility and charging infrastructure. This integrated approach enables us to offer a single-window, future-ready solution for the entire green energy journey, rather than isolated products or short-term cost plays.

What emphasis do you place on after-sales service, warranties and O&M support?

After-sales service is as critical as the initial project delivery. Strong O&M practices, clear warranty enforcement and performance guarantees are essential to protect plant performance and cash flows over the long term. As projects age and undergo refinancing or ownership changes, asset reliability, uptime and predictable generation become key decision factors for investors and lenders. In today’s market, consistent service quality is often what builds long-term customer trust and differentiates serious players from the rest.

How are digital tools like AI monitoring and data analytics shaping plant performance and maintenance?

AI-based monitoring, drone inspections and predictive analytics are transforming solar O&M. These tools help reduce downtime, optimise cleaning cycles and improve yield forecasting. As plants scale up and hybridisation increases, digitalisation is no longer optional, it is becoming a core requirement for efficient asset management.

What are the major challenges in executing solar projects today: land, grid, approvals, logistics?

Land availability, timely evacuation readiness, approval timelines and right-of-way issues continue to be the key execution challenges, as also highlighted in various discussions by the CEA and the Ministry of Power. While Gujarat’s RE park model, common evacuation infrastructure and proactive state facilitation have significantly eased these bottlenecks, coordination across multiple agencies remains critical as project sizes and complexities increase. Additionally, the mandatory use of DCR modules in certain segments could pose challenges, particularly for the commercial and industrial (C&I) market. Higher module costs may impact overall project economics, increase capital expenditure and potentially affect returns on investment, especially for price-sensitive consumers. Managing this transition will require a careful balance between domestic manufacturing objectives and maintaining project viability.

A new challenge emerging globally is solar PV waste and recycling. How do you see this shaping the sector?

Solar PV recycling will be a major issue in the coming decade. Studies by CEEW and global agencies indicate that India could face lakh-tonne-scale solar waste by 2030 and multi-million-tonne levels by 2050 as early installations retire. This presents both a challenge and an opportunity. Recycling enables recovery of critical materials like aluminium, silicon, copper and silver, reduces import dependence, and supports a circular economy aligned with Make in India and Net Zero goals. While solar modules are now covered under E-Waste Rules and EPR, the sector needs clearer guidelines, viable recycling economics and dedicated infrastructure. Addressing this early will be critical for the long-term sustainability of India’s solar growth story. India’s renewable energy transition is now moving from capacity addition to system maturity encompassing manufacturing, grid integration, storage, digitalisation and lifecycle sustainability. With strong policy signals from MNRE, NITI Aayog and progressive States like Gujarat, the next phase will be defined by quality, resilience and circularity, not just megawatts installed.

Tags