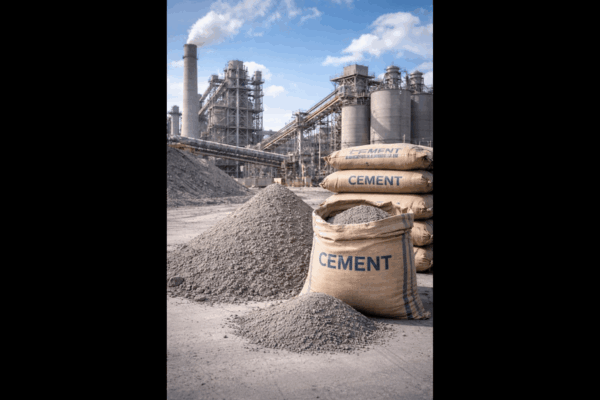

Mortaring Ahead: Budget’s Focus on High-Offtake Sectors to Drive Cement Demand

by Sehul Bhatt, Director, Crisil intelligence

The cement industry is poised to benefit from a shift in focus of the Union Budget for next fiscal – to building resilience across sectors – for realising the government’s long-term vision for the economy.

After rebounding in fiscal 2026, cement demand growth is estimated to further increase to 7-8% in fiscal 2027. The industrial and commercial segment (I&C) and rural housing segment are anticipated to lead growth, rising 8-9% and 7.5-8.5%, respectively, even as the focus on infrastructure and housing continues.

The budgetary boost for these end-use sectors will have a multiplier effect on cement demand considering these are high on offtake. The I&C segment will benefit from sharper focus on private investment, supported by reforms for ease of doing business, increasing liquidity, equity support to micro, small and medium enterprises, and the scheme to revive ~200 industrial clusters. The impetus for logistics and rising connectivity will also help.

The rural housing segment follows, with the revised tax slabs, higher tax rebate limit announced in the previous year, and goods and services tax (GST) rationalisation to increase disposable income and support overall housing in the near term. The increase in PMAY-G allocation – up 69% in the budget estimate (BE) for next fiscal over the revised estimate (RE) for this fiscal – will support rural housing. Rise in allocation towards other rural development schemes – RKVY and PMKSY – and focus on improving crop yields will spur crop profitability and yield, increasing rural incomes and helping rural housing. We expect infrastructure to grow a healthy ~8%, albeit at a marginally lower pace than housing and I&C. The 18.1% rise in budgeted capex for core infrastructure ministries1 (fiscal 2027BE as against fiscal 2026RE) will help – allocation for roads is up ~8% and National Highways Authority of India has received a 10% increase.

The east and central regions will lead growth on a lower development base, followed by the south. In the east, the proposed dedicated freight corridor connecting Dankuni in the east and Surat in the west is expected to support demand, even as the development of HSR corridors from Delhi to Varanasi and Varanasi to Siliguri will help the central region. The south will likely benefit from the improving real estate segment on account of rising investment in data centres, IT parks and global capability centres. Further, the announced HSR corridor from Pune to Hyderabad, Hyderabad to Bengaluru, Hyderabad to Chennai and Chennai to Bangaluru, will incentivise cement demand.

The total cement capacity, which was at ~666 million tonne as of fiscal 2025, is estimated to rise ~1.4 times till fiscal 2030, with the south and central region leading additions. Demand will be helped by prices, which are likely to decline ~2% on-year this fiscal following the GST rationalisation. Next fiscal, however, prices are expected to remain range-bound owing to stiff competition and rising capacity additions. Since cement is one of the most polluting sectors, players have implemented measures for a more sustainable footprint. This includes adoption of WHRS, AFR, renewable sources of energy and substitution of clinker. Overall, the budget would benefit cement demand in near term as well as long term, indicating a positive impact.

Tags