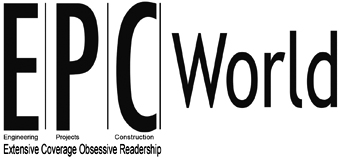

Ambuja Cements Board Approves Amalgamation of ACC and Orient Cement

The Board of Directors of Ambuja Cements, part of the Adani Group, has approved two separate Schemes of Amalgamation to merge ACC and Orient Cement. These two separate Schemes of Amalgamation will establish a single consolidated ‘One Cement Platform’ for the Adani Group.

Karan Adani, Non-Executive Director, Ambuja Cements said, “This consolidation represents a transformational step in building a globally competitive, integrated cement and building materials organisation. By bringing Ambuja Cements, ACC, and Orient Cement under a single corporate structure, we are strengthening our ability to drive operational excellence, accelerate growth, and deliver sustainable long-term value. This merger builds on our already proven track record to further position the business to drive efficiency and productivity. A robust and resilient balance sheet positions the unified strong entity to effectively support future growth initiatives.”

This consolidation is a major step for Adani Group’s cement business, creating an integrated and stronger entity with greater scale, efficiencies, and financial strength.

Operational and Financial Synergies: The merger will unlock greater operational efficiencies, optimise manufacturing and logistics, and enable efficient capital deployment. These improvements will boost profitability, support capacity expansion, and enhance long-term shareholder returns.

Simplified Corporate Structure: The amalgamation eliminates structural duplication, reduces administrative costs, and enables faster, more agile decision-making. In addition, there will be no specific MSA required with ACC, Orient, Penna & Sanghi as these subsidiaries will become an integral part of Ambuja Cements.

Strong and Debt-Free Balance Sheet: This initiative aligns with Ambuja Cements’ strategic plan to increase cement production capacity from 107 MTPA to 155 MTPA by FY28, facilitating efficient capital allocation and prompt adaptation to market requirements.

Direct Shareholding in a Stronger Entity: This strategic amalgamation is not just a merger of companies; it is a powerful step forward for shareholders, offering direct participation in a stronger, more agile, and future-ready leader in the cement industry.

Enhanced Scale and Market Leadership: The proposed amalgamation brings together two of India’s most established and trusted cement brands (ie, Ambuja & ACC) under one unified corporate structure. The ‘Adani Ambuja Cements’ & ‘Adani ACC’ brands will continue to operate as usual, with their leading product brands in respective markets.

Stakeholder-Centric Approach: The Scheme of Amalgamation of Sanghi Industries and Penna Cement with Ambuja are also at different stages of approval. Post approvals, all stakeholders will engage with a single, unified company.

Unified ESG Leadership: The merged entity will benefit from a consolidated ESG framework to accelerate renewable energy adoption, low-carbon cement solutions, and sustainable practices.

GT Valuation Advisors and BDO Valuation Advisory acted as independent joint valuers for the transaction, with IDBI Capital Markets & Securities and SBI Capital Markets providing fairness opinions, while Cyril Amarchand Mangaldas and Singhi & Co served as legal advisors.

Tags