Interview: Gnanajothi Anandan, EPC Head, Datta Power Infra

Several government programs and corporate commitments aim to localize key battery components while attracting foreign technology and capital to speed up deployment

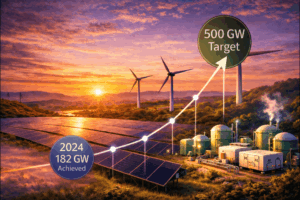

As India crosses 180 GW of installed renewable capacity, effective integration into the grid demands advanced energy storage solutions. How is India enhancing its battery storage infrastructure to support round-the-clock renewable power?

India has moved quickly from pilot demonstrations to large-scale tenders and hybrid auctions that pair storage with solar and wind, driven by both central procurement and state-level initiatives. Between 2022 and mid-2025 the country auctioned multiple standalone and hybrid BESS projects; however, a sizeable pipeline still remains under construction, and operational capacity is only a fraction of what has been awarded, highlighting that India’s focus is now squarely on scaling manufacturing, financing and grid-integration to convert that pipeline into dispatchable supply. On the execution side, the market is seeing three complementary moves: tenders for hybrid solar+storage and standalone BESS to create firm, round-the-clock power; pilot “storage-as-a-service” and merchant storage models to improve utilization and commercial viability; and development of domestic battery value chains and strategic partnerships to reduce costs and supply risk. Projects such as recently commissioned solar+storage plants that are supplying low-cost firm power demonstrate the operational value of BESS in evening/peak balancing and grid firming. Our approach is aligning project development with these national priorities by designing hybrid project bids that integrate storage capacity for weekday peak-shaving and ancillary services, while piloting lifecycle-based O&M and performance guarantees to de-risk bankability for lenders and investors.

With the global battery energy storage market projected to surpass $190 billion by 2030, how are Indian investments aligning with this trajectory? What are the national targets, and how are domestic companies and global players contributing?

India’s policy direction and large renewable pipeline are aligning capital toward storage. Authorities and market analysts reference ambitious medium-term deployment scenarios (tens of GW of BESS by the early 2030s), and multiple public and private players have announced manufacturing, EPC and financing commitments to capture the growing market. Several government programs and corporate commitments aim to localize key battery components while attracting foreign technology and capital to speed up deployment. National targets are embedded in broader goals, notably the 500 GW non-fossil capacity target by 2030 and the Green Hydrogen Mission (which itself implies very large additional renewable capacity and flexible storage needs). While explicit national BESS GW targets vary by source and time horizon, a commonly cited planning number in industry studies is tens of gigawatts of BESS by the early-to-mid-2030s, with many agencies and corporates working to convert auctioned capacity into operational projects. In practice this means a mix of domestic champions scaling manufacturing, international OEMs providing cells/inverters and system integrators, and financiers creating tailored debt and structured-offtake products. We are actively engaging suppliers and technology partners when structuring storage-inclusive bids. Our strategy is to stack revenues (energy, capacity/firming, ancillary services) to improve project IRRs, and to collaborate with battery manufacturers on long-term supply agreements that protect project timelines and cost assumptions.

Despite the acceleration, challenges like intermittency, transmission bottlenecks, and grid integration remain. What are the most pressing obstacles today, and how is the national grid evolving to accommodate variable renewable power?

The most pressing obstacles are execution and system-level constraints: project execution lag – a large amount of contracted/auctioned storage is not yet operational; transmission and evacuation bottlenecks, especially where renewables are clustered; market and ancillary frameworks that are still maturing for storage (eg, clear remuneration for multi-service value streams); and supply chain and financing risks that affect delivery timelines and costs. These issues mean that while capacity numbers look strong on paper, delivering predictable, firm power at scale requires coordinated improvements across transmission planning, market design and project implementation. To address these constraints, India’s grid operators and regulators are: accelerating transmission investments (including ultra-high-voltage and inter-state links), introducing market products for ancillary services and capacity, piloting hybrid auctions and storage-as-a-service structures, and strengthening forecasting/dispatch through advanced SCADA, forecasting tools and energy management systems. State-centered initiatives (eg, procurement by DISCOMs for firm renewable power) and innovative contracting (longer-term offtake agreements that allow financing for BESS) are also emerging as practical fixes. These steps, together with targeted policy support—are reducing integration risk for large-scale renewables. Our response is to build grid-integration risk mitigation into project bids, for example, by coordinating early with transmission planners, sizing storage to reduce congestion penalties, and offering grid-support services that align with state DISCOM needs. We also prioritize sites with existing evacuation capacity or clear transmission timelines to avoid execution delay.

From Green Hydrogen Mission and PM-KUSUM to updated feed-in tariffs and Viability Gap Funding (VGF), what recent policy interventions are having the greatest impact? How does India’s regulatory strategy compare with global leaders?

Policy interventions driving impact today are twofold: demand-creating missions — notably the National Green Hydrogen Mission, which mobilizes capital and signals long-term demand for renewables+flexibility; and distributed/sectoral programs — such as PM-KUSUM, which accelerate decentralised solar and agricultural pump electrification while reducing diesel dependence. These schemes are complemented by targeted financial support (VGF in selective competitive tenders), structured auctions for hybrid projects, and incentive frameworks to attract manufacturing and private capital. Collectively they lower both demand and supply-side barriers, helping India internalize more of the clean energy value chain. Compared to global leaders, India’s approach is pragmatic and scale-oriented: rather than relying solely on subsidies, it combines ambitious mission targets, competitive auctions, local manufacturing incentives and public-private financing. This yields rapid capacity additions and cost competitiveness (as recent record low firm-green tariffs show), though it also requires continued emphasis on execution, grid expansion and storage commercialization to match the operational stability of countries with more mature storage markets. In short: India is moving quickly to marry scale with competitiveness, while learning to close the execution and grid-market gaps that come with rapid deployment. Our policy view welcomes mission-level clarity (eg, PM-KUSUM) because they improve long-term project visibility. We actively design projects to be policy-aligned, for instance, structuring bids eligible for VGF or subsidy components where relevant, and participating in programs that improve bankability for distributed generation and storage.

Innovations like smart grids, IoT-based energy management, and AI for predictive maintenance are transforming how renewable energy is generated, stored, and distributed. How are Indian firms leveraging these to improve efficiency and resilience?

Indian developers, EPCs and O&M firms are rapidly adopting digital solutions for every stage of the asset lifecycle. Smart inverters, IoT sensors and AI-driven analytics are being used for precise short-term forecasting, predictive maintenance (reducing downtime and O&M costs), battery health monitoring, and centralized energy management across hybrid parks. Grid operators and aggregators are also piloting virtual power plants (VPPs) and advanced EMS platforms that can coordinate distributed assets to provide market services, smoothing variability and maximizing asset utilization. Practical benefits are tangible: improved availability through predictive alerts, better state-of-charge management for batteries, automated curtailment decisions to protect grid stability, and software-enabled revenue stacking (energy + ancillary + capacity). AI and cloud-based control also allow asset owners to remotely optimize fleet performance and to monetize flexibility in short-duration markets. As market rules evolve to recognize these services, digital capabilities will be a differentiator in project returns and resilience. Our technology stance is integrating advanced EMS and predictive O&M into its project playbook, deploying IoT telemetry across solar arrays and BESS, using analytics to extend battery life and to optimize dispatch, and partnering with software integrators to enable revenue stacking. These investments lower lifecycle cost and improve the bankability of storage-enabled renewables that DPIPL builds and operates.

Tags