India’s Power Sector in 2025: Crossroads of Growth, Innovation, and Challenge

With a near-universally electrified population, a renewables-led transformation, and a surging investment pipeline, India’s power sector is undergoing a profound transition, driven by technological breakthroughs and the urgent need for financial and operational stability. EPC World explores...

Power Landscape in 2025

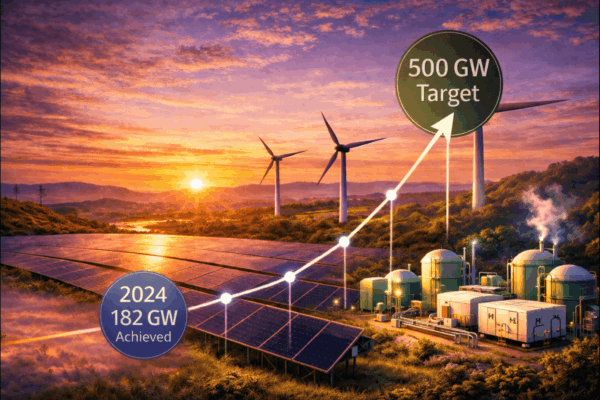

India’s electricity generation surpassed 1,949 TWh in FY 2023–24, cementing its status as the world’s third-largest producer. Coal still dominates, contributing roughly half of India’s 476 GW installed capacity, but renewables—including large hydro—now account for almost half of all installed capacity, with solar (over 94 GW) and wind (over 51 GW) at the forefront. Per capita power consumption, though rising, remains below the global average at around 1,400 kWh, signaling both unmet demand and significant growth potential. Despite near-universal village electrification, high transmission losses—about 15%–20%—and persistent DISCOM financial instability continue to challenge sector performance.

Opportunity: A $460 Billion Investment Playground

India’s power sector presents a Rs. 40 lakh crore (USD 462 billion) investment opportunity over the next decade, with projections of required investments reaching even higher by 2035 as demand triples—driven by urbanization, industrialization, electrification of transport, and digital infrastructure. The renewable energy sector, especially solar and wind, is projected to grow at a 26.5% CAGR, eclipsing all other segments.

Key investment areas:

- Renewable Energy Parks: Solar and wind parks, including floating solar, offshore wind, and hybrid projects.

- Transmission and Grid Upgrades: Modern HVDC lines, smart grids, and digital substations.

- Energy Storage: Grid-scale batteries, pumped hydro, and innovative thermal storage.

- Green Hydrogen: Electrolyzer manufacturing, pilot plants, and export infrastructure.

- Distributed and Rooftop Solar: Aggregated behind-the-meter capacity for homes and businesses.

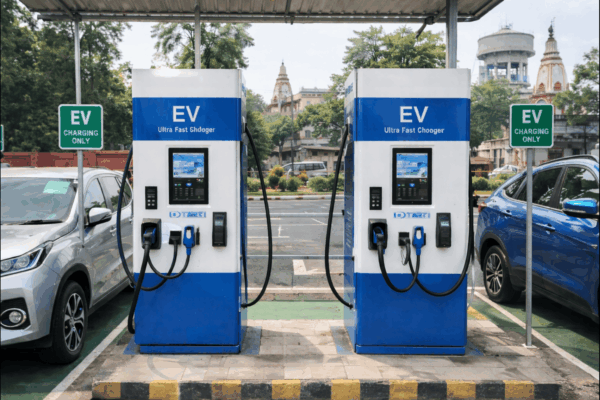

- Electric Mobility: Charging infrastructure, integration with the grid, and vehicle-to-grid (V2G) technology.

The government’s 100% FDI policy for renewables has attracted over $3.8 billion in recent years, with global investors seeking a stake in India’s green transition.

Technological Advancements Powering the Transition

India’s energy transition is increasingly defined by rapid technological innovation—delivering efficiency gains, cost reductions, and new business models.

Smart Grids and Digitalization

Smart grids—equipped with AI, machine learning, IoT sensors, and cloud analytics—are transforming how electricity is generated, transmitted, and consumed. In Rajasthan, advanced grid automation and real-time monitoring have reduced technical losses and improved reliability. Smart meters, rolled out at scale, enable accurate billing, demand response, and dynamic pricing—empowering consumers and reducing DISCOM losses.

Breakthroughs in Solar and Wind

- Bifacial Solar Panels: Capture sunlight on both sides, boosting efficiency by 10%–20% compared to traditional panels.

- Floating Solar: Deployed on reservoirs and lakes, these systems save land and reduce evaporation.

- Advanced Inverters: Enable seamless integration of rooftop solar into the grid.

- AI-Powered Wind Forecasting: Improves grid stability by predicting generation fluctuations.

- Offshore Wind Farms: Projects off Gujarat and Tamil Nadu coasts are set to unlock new capacity.

Energy Storage Solutions

- Lithium-Ion Batteries: Rapidly falling costs make grid-scale storage viable for renewable integration.

- Flow Batteries and Thermal Storage: Emerging technologies for longer-duration storage.

- Pumped Hydro Storage: Large-scale projects under development to balance supply and demand.

High-Voltage Direct Current (HVDC) Transmission

The 6,000 MW Raigarh-Pugalur HVDC link, spanning 1,765 km, enables efficient, low-loss transfer of renewable power from resource-rich regions to high-demand urban centers. This technology, combined with digital substations, is critical for India’s renewable ambitions.

Emerging Frontiers: Green Hydrogen and Small Modular Reactors (SMRs)

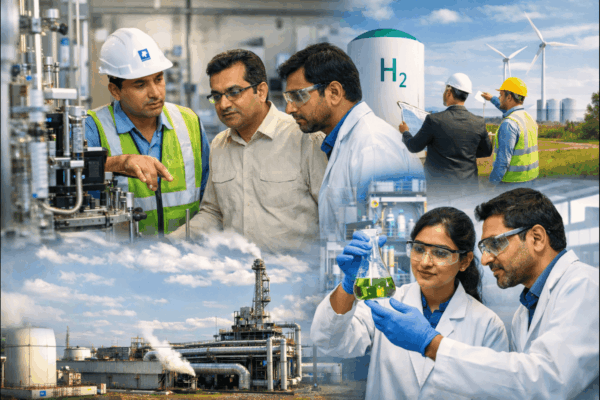

- Green Hydrogen: India is investing in pilot plants and electrolyzer manufacturing, aiming to leverage surplus solar and wind to produce carbon-free hydrogen for industry and transport. Cost remains a barrier, but government subsidies and global partnerships are accelerating deployment.

- SMRs: Small modular nuclear reactors offer a flexible, safer alternative to large nuclear plants, ideal for replacing captive thermal capacity in heavy industry. India plans to deploy 40–50 SMRs in the coming decade, playing a strategic role in the net-zero transition.

Challenges and Barriers

Despite progress, major hurdles remain:

- DISCOM Financial Health: Under-recovery, inefficient operations, and high technical losses strain state coffers, undermining investment in renewables and modernization.

- Grid Integration: Managing the variability of solar and wind requires massive upgrades in transmission, storage, and flexible generation.

- Land and Regulatory Delays: Slow approvals and land acquisition hamper project rollout.

- Technology Adoption Gaps: While urban areas benefit from smart infrastructure, rural and semi-urban regions lag in digital penetration.

- Supply Chain Risks: Dependence on imports for lithium, electrolyzers, and other critical components could slow the energy transition.

DISCOMs at the Heart of India’s Power Transition

India’s power sector is navigating a transformative period, tackling ambitious targets and a complex mix of financial and technical challenges with innovative responses. Distribution companies (DISCOMs), the backbone of power delivery, remain under financial stress with aggregate technical and commercial (AT&C) losses averaging 15–18%, much higher than the 6–7% seen in advanced economies.

Despite government interventions like UDAY and the new Reforms-Linked, Result-Based Scheme, recent data shows DISCOM arrears nearing $14 billion, with nearly a fifth owed to renewable power producers. To improve financial stability and enable deeper renewable integration, DISCOMs are accelerating the rollout of smart metering, which enhances billing efficiency, reduces losses from theft, and supports granular demand forecasts. Policy moves toward more frequent tariff rationalization, digital payment platforms, and enhanced corporate governance are helping, but state-level politics and insufficient cross-subsidy reforms continue to impede significant progress.

In parallel, India’s renewables sector continues to make remarkable strides due to continual innovation, cost decline, and technological adoption. Here are the most impactful innovations:

- Smart Metering & Digitalization

DISCOMs are rolling out smart meters at scale, which provide real-time consumption data, automatic tamper alerts, and remote disconnection features. This innovation supports improved billing, reduces theft, enables prepaid models, and generates detailed demand forecasts for grid operators. - Advanced Tariff and Payment Systems

Adoption of digital payment platforms and periodic tariff recalibration (aimed at cost-reflectivity) enhances transparency, improves cash flows, and limits the growth of arrears. - Bifacial & Floating Solar Panels

Bifacial solar panels, capable of absorbing sunlight on both sides, have increased energy yield by up to 20% in pilot projects. Floating solar arrays placed on reservoirs and lakes conserve land, minimise evaporation, and offer higher efficiency due to the cooling effect of water. - Competitive Auctions

Transparent and competitive bidding processes for solar and wind projects have consistently driven down tariffs, with solar now reliably below ₹2/kWh—a historic low that makes renewables India’s cheapest new power source. - Advanced Inverters & Predictive Analytics

The deployment of modern inverters, capable of handling complex grid conditions and supporting reactive power management, is accelerating rooftop and distributed solar integration. AI-driven forecasting platforms allow more accurate scheduling and balancing of renewable sources. - Smart Grid Pilots:

States like Rajasthan lead with AI-enabled grid automation, real-time fault detection, and demand response mechanisms, which collectively reduce technical losses, enhance power quality, and support a higher share of renewables in the grid. - Energy Storage

Lithium-ion battery storage and pilot projects in pumped hydro are being scaled to absorb surplus renewable generation and deliver peak power reliably. - HVDC Transmission

The commissioning of ultra-high-voltage lines like Raigarh–Pugalur has transformed interregional power flows, allowing renewable-rich regions to supply urban centers efficiently, with minimal transmission losses and voltage drops. - Green Hydrogen Innovation:

Efforts are underway to localize electrolyzer production, reduce capital costs, and establish initial green hydrogen corridors under the National Green Hydrogen Mission. Yet, high electrolyzer costs (still in the $4–5/kg range), fragmented regulations, and limited state incentives remain barriers. - Small Modular Reactors (SMRs):

SMRs are poised to complement variable renewables by providing low-carbon baseload power and supporting industrial decarbonization. India’s plans to deploy up to 50 SMRs by 2035 signal major investment in nuclear innovation for a net-zero future.

However, even with these innovations, systemic reforms—in tariff policy, corporate governance, R&D investment, and DISCOM accountability—are crucial if India is to fully unlock its renewable energy ambitions, ensure grid resilience, and meet the surging demand of a rapidly modernizing economy.

The Road Ahead: Policy, Investment, and Innovation

To realize its energy ambitions, India must:

- Accelerate DISCOM Reforms: Improve financial health through privatization, digitalization, and cost-reflective tariffs.

- Boost Renewable Deployment: Fast-track land clearances, grid integration, and storage solutions.

- Invest in R&D: Support homegrown innovation in batteries, hydrogen, and modular nuclear.

- Foster Public-Private Partnerships: Leverage global capital and expertise for large-scale projects.

- Empower Consumers: Expand rooftop solar, demand response, and electric mobility.

India’s power sector faces a pivotal moment. The combination of rising demand, groundbreaking technological advances, and a substantial investment pipeline creates the opportunity to establish a resilient, sustainable, and inclusive energy system. However, success relies on courageous reforms, swift adoption of new technologies, and a continuous focus on efficiency and financial viability.

The choices made in this decade will determine whether India becomes a global clean energy leader or remains constrained by legacy inefficiencies and financial stress. The time for decisive action is now.

Tags