Engineering the future: Overcoming EPC challenges in building India’s CBG ecosystem

by Anmol Mudholkar, Director – Sugar, Cogen and Bio-Chemicals, TKIL Industries

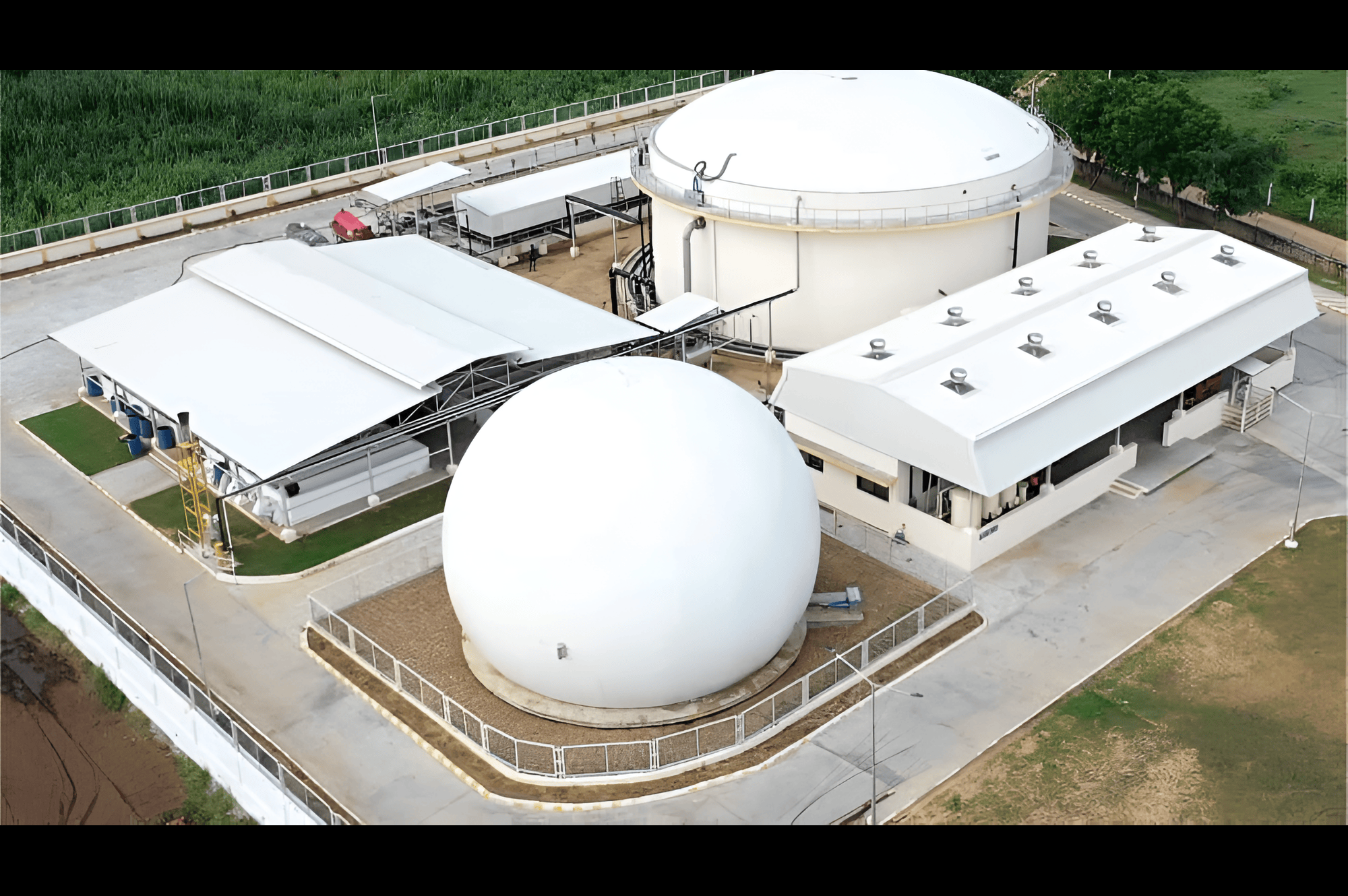

India’s ambition to increase the share of natural gas in its energy mix from 7% to 15% by 2030 has placed Compressed Biogas (CBG) at the centre of its clean energy roadmap. As a renewable, domestic fuel derived from agricultural residue, animal waste, and municipal solid waste, CBG offers a sustainable pathway to decarbonize India’s transport sector and reduce dependency on fossil fuel imports. Because of its similar composition and calorific value to natural gas, CBG can be used in a variety of applications. Apart from serving as a fuel alternative, CBG has the potential to yield substantial environmental advantages by lowering emissions, promoting the production of organic manure, and maintaining rural livelihoods. As it works toward the Net Zero goal by 2070, CBG is a key and crucial component of India’s sustainable energy pathway, supporting initiatives like Swachh Bharat, Atmanirbhar Bharat, and SATAT (Sustainable Alternative Towards Affordable Transportation).

With an estimated potential of 40 million metric tonnes (MMT), the CBG sector has attracted growing attention from public and private players alike. Certain states display higher potential, owing to their strong feedstock availability and favourable project ecosystem. As of April 2024, 68 CBG plants and 194 retail outlets have been commissioned, with a target of 750 plants by 2029.

Policy backdrop: An enabling but evolving framework

India’s policy push has been critical in accelerating momentum. Flagship schemes like SATAT (Sustainable Alternative Towards Affordable Transportation) launched in 2018, and the National Bioenergy Programme with a cumulative outlay of ₹17.15 billion, aim to promote CBG generation and distribution.

Recent policy developments include guidelines for injecting CBG into City Gas Distribution (CGD) networks, blending mandates, and financial incentives for plant developers. Additionally, programs like GOBARdhan and the PM JI-VAN Yojana promote bioenergy innovation and have broadened the eligibility scope for advanced biofuel projects.

Project viability: A matter of scale and structure

CBG projects are capital-intensive, with upfront costs accounting for majority of total expenditure. The capital cost varies significantly based on plant capacity, offtake models, and technology employed. For example, a small (<5 TPD) plant under the retail model can cost nearly double that of a direct pipeline injection model. Larger plants (>100 TPD) offer improved economies of scale, showing IRRs of up to 21% and stronger DSCRs—yet require far greater investment and feedstock certainty.

Viability hinges on several interlinked factors:

- Feedstock security and quality

- Scalable, proven technologies

- Bankable long-term offtake agreements

- Revenue from by-products like fermented organic manure and carbon credits

Banks remain cautious, citing low margins, untested business models, and technological uncertainty. Credit guarantee mechanisms and low-collateral lending schemes are needed to bridge this gap.

EPC challenges: Navigating complex ground realities

The EPC model underpins CBG plant development, but several bottlenecks limit its effectiveness:

- Cost and Budget Overruns:

Volatile input prices, labour scarcity, and project delays often lead to budget overshoots. Accurate cost estimation and robust risk assessment frameworks are critical for containment. - Project Delays:

Timeline slippages due to regulatory delays, logistical bottlenecks, and unpredictable weather events affect profitability. Advanced tools like BIM and ERP systems can enhance real-time monitoring and planning. - Regulatory Compliance:

Adherence to environmental, safety, and quality standards adds complexity and cost. Streamlined permitting processes and automated compliance systems are needed. - Skilled Workforce Shortage:

The transition to modern technologies necessitates upskilling. Public-private collaborations with vocational training centres can help build the required talent pipeline. - Supply Chain Disruptions:

The EPC sector’s dependency on timely delivery of critical equipment makes it vulnerable to disruptions. A diversified supplier base and digital supply chain platforms can enhance resilience. - Technology Gaps:

Many CBG plants still operate using outdated technology, which hampers efficiency and scale. Adoption of automation, IoT, and AI must be prioritized through strategic partnerships and phased digital transformation. - Contractual and Legal Risks:

Disputes related to design changes or scope creep can derail projects. Standardized contracts and effective conflict resolution frameworks are imperative.

Addressing the feedstock paradox

Despite the abundance of organic waste in India, effective segregation and logistics remain major challenges. Improper handling damages anaerobic digesters and affects yield. Paddy straw, in particular, is difficult due to its high moisture variability. The sector requires:

- Aggregator partnerships for feedstock collection

- Improved storage infrastructure

- Localized surplus mapping at the tehsil level

Unlocking offtake potential and infrastructure gaps

Mid-sized CBG plants often struggle to market both gas and manure. Current offtake guarantees (50%) are inadequate—developers seek full guarantees for initial years. The subsidy cap of 75 km for pipeline connectivity limits scalability for plants located farther from the grid. Enhanced support for transport and marketing infrastructure is essential.

A number of factors like encouraging government policy, strong offtakes with Oil Marketing Companies (OMC), and rising awareness of sustainable fuel alternatives, are currently in place and are creating positive momentum for private sector engagement in the CBG space. With growing investment, feedstock supply chains, and improvements in gas purification technology, we are beginning to see the industry’s potential. As long as we can collaborate with the government and industry, this is proving that CBG can deliver a sustainable, scalable, and renewable energy source. In addition to accomplishing waste-to-wealth agendas, generating jobs in rural areas of the nation, and improving energy security, we have a rare opportunity to accelerate India’s green transition.

Tags